Load Cell Customs Clearance in Iran (HS Code + Documents and Permits)

To estimate the time and cost of load cell customs clearance (Load Cell), contact the experts at Saba Tarkhis.

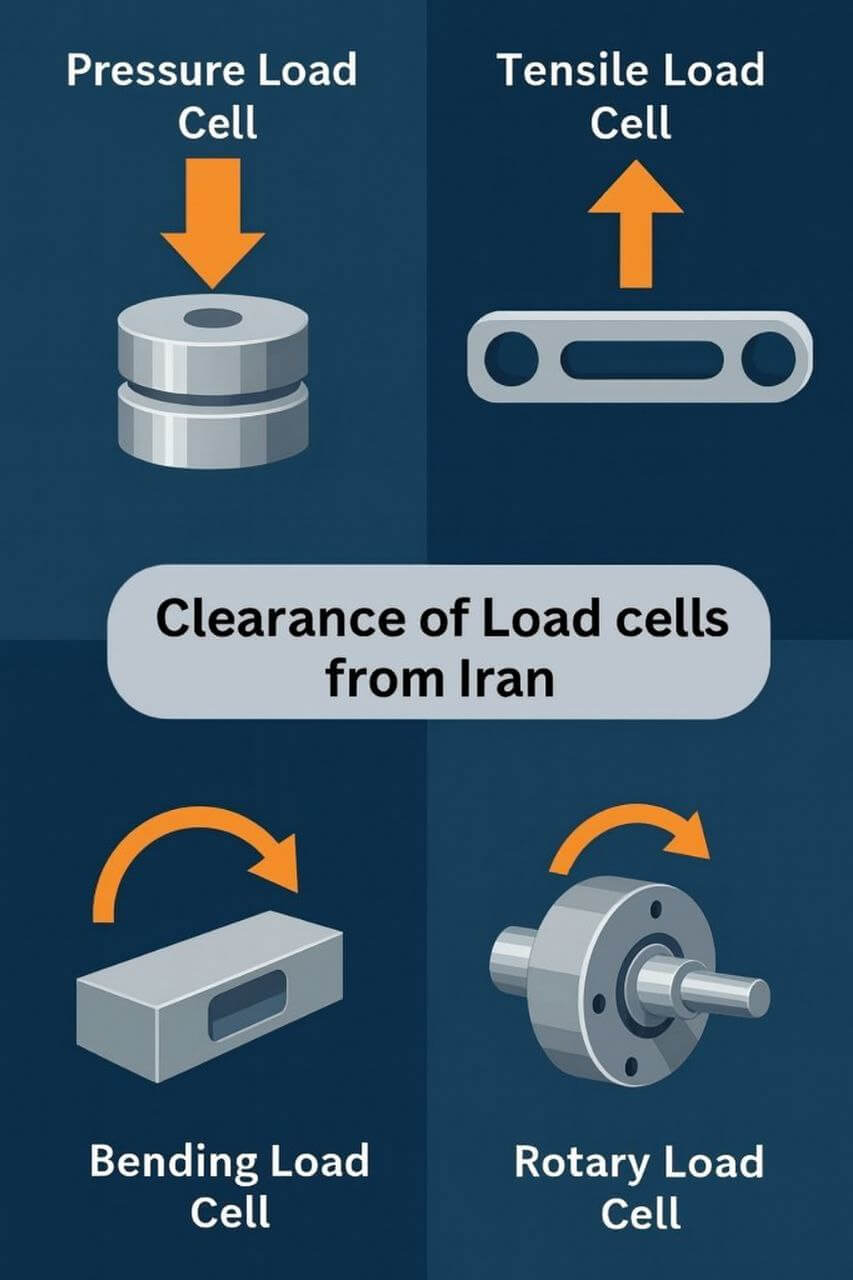

Instant & Free Consultation1) Types of Load Cells and Their Specialized Applications

1. Compression Load Cell

Features: Compression load cells are designed to measure compressive forces applied to a specific surface. This type typically measures heavy loads and high pressures.

Applications:

Construction industry: Measuring loads applied to structures and construction equipment.

Automotive: Measuring loads applied to vehicle parts and components.

Heavy materials production: Such as steel and concrete, to examine production pressures and resistance.

Customs tariff code: HS Code 9031.80.00 – includes compression load cells and pressure-measuring equipment.

2. Tension Load Cell

Features: Tension load cells are designed to measure tensile forces or stresses applied to an object. These load cells can accurately measure tensile variations in different materials.

Applications:

Cable and wire manufacturing: For precise measurement of tensile stress during production.

Elastic industries: Such as rubber and plastic production, to assess tensile properties of materials.

Research laboratories: For measuring and analyzing tensile forces in R&D.

Customs tariff code: HS Code 9031.80.00 – under the category of tension measurement and control equipment.

3. Bending Load Cell

Features: Bending load cells are designed to measure forces that cause bending or deflection of an object. This type is usually used to analyze bending variations and internal stresses.

Applications:

Resistant materials manufacturing: Such as steel and concrete, to assess bending characteristics and internal stresses.

Strength testing labs: To examine material resistance under bending loads.

Manufacturing and construction: For quality control and testing of materials and products.

Customs tariff code: HS Code 9031.80.00 – in the subset of bending and stress measurement equipment.

4. Torque Load Cell

Features: Torque load cells are used to measure torque applied to a shaft or component. These load cells can accurately measure torsional forces and torque.

Applications:

Automotive industry: Measuring and controlling torque in car engines and rotating components.

Aerospace industry: Examining torsional forces and torque in jet engines and complex systems.

Engineering laboratories: For analysis and testing of torque and torsional forces in research and development projects.

Customs tariff code: HS Code 9031.80.00 – includes torque and torsional force measuring equipment.

2) Global Load Cell Market Status and Exporting/Importing Countries

Load cell exporting countries

China: As the largest load cell manufacturer and exporter in the world, China controls a major share of the global market. Chinese load cells, thanks to competitive prices and acceptable quality, are popular in many countries.

Germany: A producer of very high-quality industrial load cells. Due to advanced technology and high precision, Germany is considered one of the major load cell exporters globally.

Japan: By producing highly precise and advanced load cells, Japan has a significant share of the global market in sensitive industries such as aerospace and medical.

United States: A producer of advanced-technology load cells with special applications in complex industries such as defense and aerospace.

Load cell importing countries

Iran: As one of the main load cell importers in the region, Iran uses products from China, Germany, and Japan. Load cell imports into Iran are increasing due to extensive industrial needs in automotive, steel, and oil & gas.

India: With the rapid growth of manufacturing industries and the need for precise equipment, India is one of the largest load cell importers in Asia.

Brazil: In South America, Brazil—owing to its extensive agriculture and food processing industries—is a principal importer of load cells.

European countries: Due to their advanced industries, these countries are also major importers of load cells.

3) Essential Documents for Clearing Load Cells from Customs

1. Proforma Invoice:

The proforma invoice is one of the main documents in the import process. Prepared by the seller, it includes key information about the goods such as quantities, unit prices, shipping and delivery conditions, and payment terms. Without this document, the next steps cannot proceed.

2. Commercial Invoice:

The commercial invoice (final invoice) is the official confirmation of the transaction between buyer and seller. It includes all transaction details such as the final value, specifications, quantities, and tax conditions, which are necessary for calculating duties and customs charges.

3. Bill of Lading (B/L):

The bill of lading is issued by the carrier and shows that the goods have been shipped to the specified destination. It provides information such as the type of goods, names of shipper and consignee, and shipment details, and is essential for tracking the shipment and facilitating clearance.

4. Certificate of Origin:

The certificate of origin is a vital import document confirming that the product was produced or processed in the country of origin. It is used to determine the customs tariff rate based on bilateral or multilateral trade agreements between countries.

5. Packing List:

This document specifies all packing details of the consignment, including the number of packages, dimensions, net and gross weights, and the packing method. This information helps customs verify that the goods match the submitted documents and ensures no violations have occurred.

6. Certificate of Compliance:

As precise weight-measuring equipment, load cells must comply with national or international standards. Compliance certificates such as CE, ISO, and other valid certificates are required as proof of product quality and accuracy. In Iran, load cells must comply with Iranian national standards or equivalent bodies.

7. Order Registration License:

To import any type of goods into Iran, obtaining an order registration license from the Ministry of Industry, Mine and Trade is mandatory. This license plays a key role in legalizing the import and aligning the goods with domestic market needs.

8. Customs Declaration:

The customs declaration contains all information related to the goods, including quantities, value, and the HS Code. It must be prepared accurately and be consistent with other documents. Any error may result in delays or clearance issues.

9. Trade Card (Business Card):

Possessing a trade card is mandatory for all importers. Issued by the Chamber of Commerce, it allows importers to legally import commercial goods. Without this card, importing goods into the country is not possible.

10. Insurance Policy:

The transport insurance policy indicates the insurance coverage of the goods during transit. This document is essential to ensure compensation in case of accidents or damage during transport and prevents financial issues from potential damages.

11. Customs Tariff (HS Code):

The HS Code for load cells must be correctly entered in the customs declaration. The tariff code for load cells is usually 8423.89.00, which relates to weighing/measuring devices. This code helps calculate customs duties accurately, and any mistake in determining it may increase import costs.

4) Key Tips for Load Cell Clearance

| Type/Application | Short Description | HS Code |

|---|---|---|

| Compression/Tension/Bending/Torque Load Cell | Force/torque measuring equipment | 9031.80.00 |

| Load cell within weighing assembly | Under weighing/measuring machines | 8423.89.00 |

Final classification depends on application, technical composition, mode of supply (standalone part or component of a machine), and technical documentation.

Need precise HS determination, obtaining permits, and document preparation? Our team manages the case end-to-end.

Submit Proforma Request

Frequently Asked Questions

What is the HS Code for load cells?

As in your text: load cells are mainly classified under 9031.80.00, and when supplied as part of weighing equipment, under 8423.89.00; the final decision depends on technical documents.

What documents are required to clear load cells?

Per your text: proforma, commercial invoice, bill of lading, certificate of origin, packing list, compliance certificates (CE/ISO), order registration license, customs declaration, trade card, insurance policy, and correct HS entry.

How can we avoid clearance delays?

By complying with standards, precisely aligning documents, obtaining the order registration before shipment, and consulting a professional broker to select the correct classification and complete the paperwork.

Specialized Customs Services by Saba Brokerage

With many years of experience in clearing goods from Iranian customs, our professional team one of the industry leaders provides specialized and comprehensive services for load cell clearance. These services are as follows:

Pre-import specialized consultation: We provide precise advice on customs tariffs, required permits, and import conditions to help you conduct the load cell import process in the best possible way. This consultation includes needs analysis, optimal solutions, and reviewing the required documentation to facilitate import.

Document preparation and completion: Our expertise in preparing and completing the documents required for clearing load cells ensures all documents are accurately prepared and submitted in the shortest possible time. With this approach, you will have no concerns about documentation, and the clearance process will proceed smoothly.

Expediting the clearance process: Given our experience and extensive connections with customs officials and related organizations, we are able to speed up the load cell clearance process. These services are designed to ensure clearance is completed in the shortest possible time and at the lowest cost. Thus, you can bring your goods to market quickly and avoid unnecessary delays.

Post-clearance support: Our services are not limited to clearance. Through post-clearance support, we ensure full alignment of imported goods with your needs. This includes advice on optimal use of load cells and sourcing spare parts if required. Our goal is to add value to your business and ensure optimal equipment performance.

By using our specialized services, you can benefit from a fast, effective, and worry-free clearance process.

.png)