Customs clearance of various papers and boards for photographic uses (HS Code + Documents & Permits)

For time and cost estimates of photographic paper & board clearance, contact Saba Tarkhis experts.

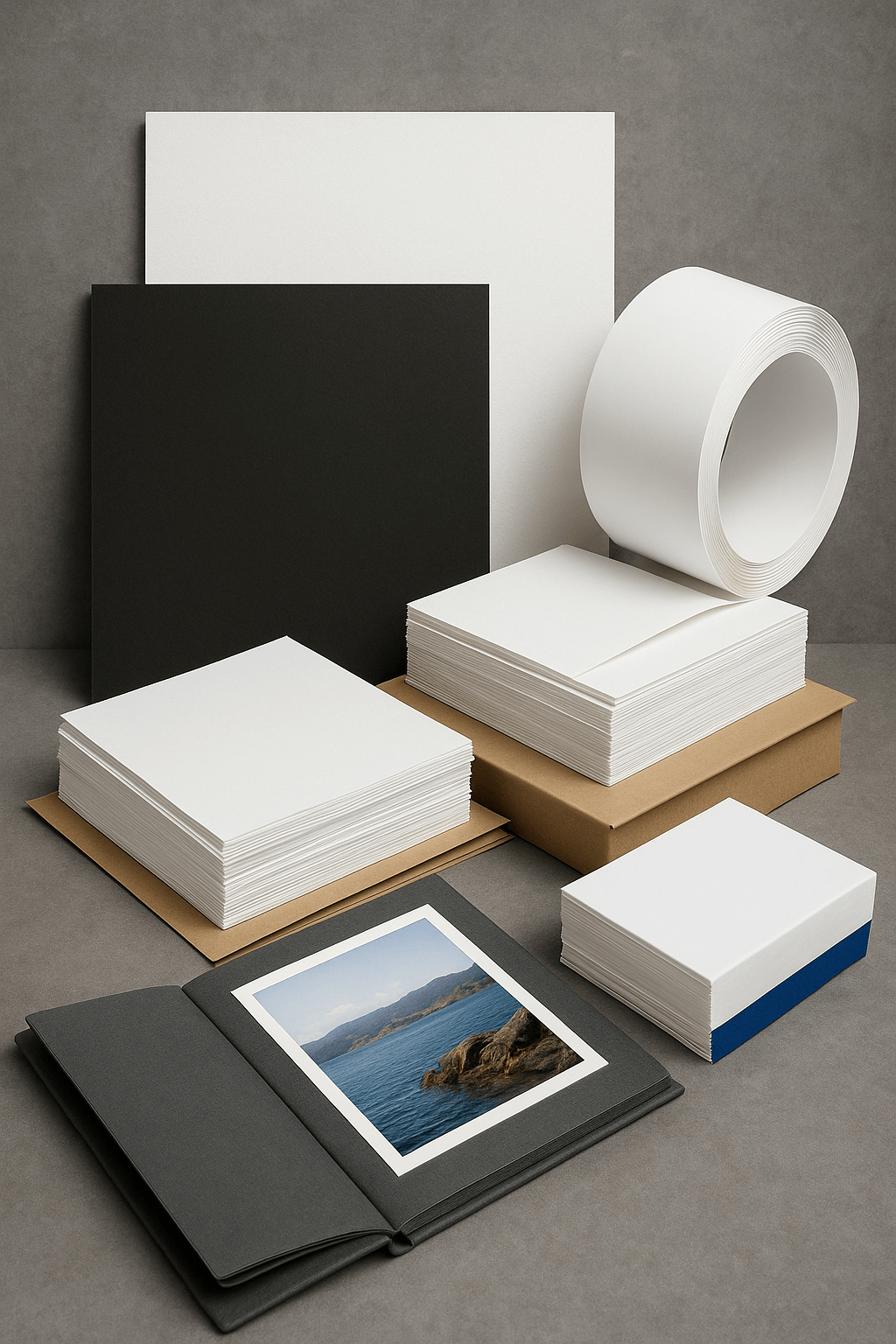

Instant free consultation1) Types of photographic camera paper and their technical features

Silver halide paper: Due to the use of silver particles in its coating, this paper delivers very high quality in capturing image details. Silver halide papers are often used for professional prints and in artistic and commercial applications. They are printed in light-controlled environments with specialized photographic equipment and offer higher color quality and image depth compared to other papers.

Inkjet papers: These papers are mostly used for printing digital photos with inkjet printers. Key features include fast printing, accurate color reproduction, and the ability to print in various sizes. They are also produced with a variety of surface coatings such as glossy, semi-gloss, and matte, which are chosen based on project type and customer needs.

2) Key points in the clearance process of photographic camera paper

Clearing photographic camera paper from customs, due to the specialized nature and sensitivities of the product, requires observing several steps and important points. The most important include:

Customs Tariff (HS Code)

| Goods | Short description | HS Code |

|---|---|---|

| Photographic paper/board, light-sensitive | Unexposed sensitized/unsensitized | 3703 |

The exact subheading may depend on coating, basis weight (gsm), roll/sheet dimensions, surface (gloss/matte/RC) and intended use.

Required documents & permits

Importing photographic papers requires specific documents and permits. These include health certificates, quality certificates, and in some cases Ministry of Culture permits for cultural products. Such permits are essential especially when the imported papers are intended for specific cultural, artistic, or advertising projects. In some cases, standard compliance certificates issued by the country of origin are also required.

Quality control & standards

The quality and technical standards of photographic camera paper are highly important. Imported papers must be produced and packaged in accordance with international standards, and their quality certificates should be issued by regulatory bodies and reputable research centers. To avoid any product quality issues and post-clearance problems, quality checks are conducted at customs.

Packaging & transportation conditions

One of the most important points in clearing photographic papers is paying attention to packaging and transportation conditions. Due to their high sensitivity to light, humidity, and temperature, these products must be placed in proper, shock-resistant packaging. Any damage to the packaging during transport can reduce product quality and may even cause the shipment to be rejected at clearance.

Warehousing & storage

At the warehousing stage, proper storage conditions are crucial. Photographic papers must be stored in locations with controlled temperature and humidity to prevent damage to their sensitive coating. This must be considered during import and clearance.

3) Major exporters and importers of photographic camera paper

4) Import and export volumes of photographic camera paper to Iran

5) Global circulation and key players

Germany: due to advanced technology producing high-quality photographic papers.

Japan: one of the leaders in printing and photographic product manufacturing.

United States: producer of professional products for global markets.

China: with large-scale, competitive production capturing a significant global share.

Main importers of photographic camera paper include:

Iran: due to high demand in printing and photography.

India: a large market for photography and digital advertising.

Brazil: an emerging market in professional printing and digital photography.

Eastern European countries: reliant on imports due to limited local production.

6) The best and simplest method to clear photographic camera paper

Place an order in the National Trade System: All technical and commercial specifications must be correctly entered. This step is critical because any deficiency or error can cause delays in clearance.

Obtain required permits: Importers need health certificates, standards approvals, and sometimes Ministry of Culture permits for cultural products. Ensuring these permits are in hand before the goods arrive at customs is one of the best ways to expedite clearance.

Customs inspection of goods: Imported goods are inspected to verify conformity with registered documents. Conducting this step accurately and with experienced customs brokers helps reduce potential issues.

Payment of customs duties and other charges: Accurate duty payment is crucial. Using HS Code 3703 for light-sensitive and photographic materials must be done carefully to avoid extra costs.

Release and delivery to warehouse: After paying duties and obtaining permits, the goods are cleared and transported to the warehouse/market. Pay close attention to transport and packaging conditions to prevent any quality damage.

7) Required documents for clearing photographic camera paper

1. Commercial Invoice (Invoice)

Issued by the seller, including product type and quantity, unit price, total price, and sales terms. It evidences the transaction and the specifications of the imported shipment.

2. Proforma Invoice

Provided before finalizing the deal, indicating initial terms, prices, and product specs; used to complete order registration in Iran’s trade systems.

3. Transport document (Bill of Lading or Airway Bill)

Issued by the carrier, including shipper/consignee, goods type, loading/unloading points, etc. It serves as the title document and proof of shipment from origin to destination.

4. Certificate of Origin

Confirms the country where the goods were produced/exported; issued by the chamber of commerce at origin. Important for preferential tariffs—especially for imports from Germany, Japan, the United States, and China.

5. Order registration in the National Trade System

Mandatory prior to import into Iran for entering product, technical/commercial specs, and all related import documents. Without it, import and clearance are impossible.

6. Health permit (if required)

Needed for certain papers used in particular industries or with sensitive hygienic applications, confirming the product’s sanitary safety.

7. Standard certificate

In some cases confirms the product is manufactured to international standards; issued by the origin country’s standards body or reputable international entities.

8. Quality Certificates

Evidence of product quality and conformity to global standards, typically issued by the manufacturer.

9. Ministry of Culture & Islamic Guidance permit (if required)

Required if the imported papers are used for cultural or artistic projects.

10. Cargo insurance policy

Confirms shipment is insured; covers losses during transit and protects the importer financially.

11. Inspection Certificate

Issued by international or local inspection bodies to confirm the goods’ quality and conformity with the seller’s declared specifications.

12. Customs Declaration

Issued by customs, detailing the imported shipment (type, quantity, value, specs). Must be prepared accurately for proper clearance.

13. Conformity Certificate

Confirms the goods comply with domestic regulations and standards. Often mandatory for products including photographic camera paper.

14. Proof of customs duties payment

Final step: after examination and document approval, the importer submits proof of duty/tax payments.

Need precise HS Code 3703, permit acquisition, and document preparation? Our team manages your case end-to-end.

Request a proforma quoteFrequently Asked Questions

What is the HS Code for photographic paper?

Photographic/light-sensitive paper/board is generally classified under 3703; detailed subheading depends on coating, gsm, and format.

What permits are needed for import?

Where applicable: health/quality certificates, standards approval, and in some cases Ministry of Culture permit for cultural/artistic applications.

What are the transport and storage notes?

Shock-resistant, moisture-protected packaging; control light/temperature during transport and storage; warehouse with controlled humidity/temperature is mandatory.

Special customs clearance services by Saba Brokerage

Due to the sensitivities and complexities involved, clearing photographic camera paper requires working with experienced, specialized customs brokers. Leveraging specialized services can make the process faster and more accurate. One of the best options to speed up and facilitate clearance is partnering with seasoned brokerages that fully know the procedures and legal requirements.

Special services include:

Specialized customs consulting: Experienced experts provide technical and legal advice, helping importers select the correct HS Code, prepare documents, and execute customs steps precisely preventing errors and accelerating clearance.

Rapid acquisition of required permits: All necessary permits including health certificates and cultural permits are obtained from government bodies in the shortest possible time, expediting imports and avoiding unnecessary delays.

Fast & efficient clearance: Through effective communication with customs authorities and extensive networks, clearance is carried out as quickly as possible so goods reach importers without customs issues.

Thorough document control: All import documents are carefully reviewed to prevent any error or deficiency that could delay clearance, ensuring problem-free release.

Professional packaging & transport: Given the sensitivity of photographic camera papers, packaging and transport conditions are closely checked so goods arrive at the final destination with original quality and no damage.

Reducing customs costs: Key services include specialized strategies to reduce customs costs and advice on tax/customs exemptions to lower importers’ final expenses.

By choosing a reputable brokerage, importers can be confident their photographic camera paper clearance will be handled quickly, accurately, and cost-effectively, with every step overseen by experts.

.png)