Customs Clearance of All Types of Coffee

For estimating the time and cost of coffee clearance, contact the experts at Saba Tarkhis.

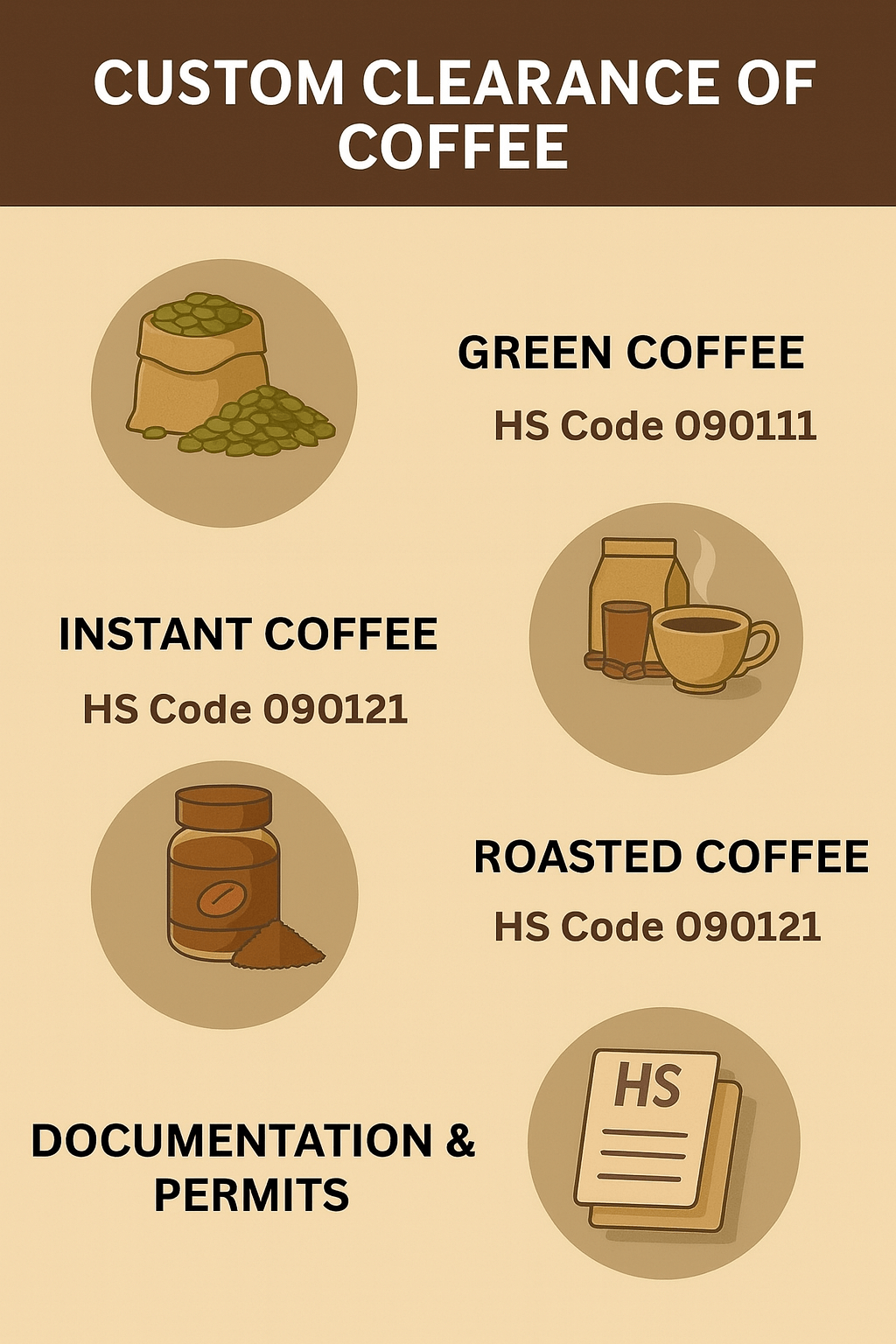

Immediate Free Consultation1) Types of Coffee and Customs Codes (HS Code)

| Type of Coffee | Short Description | HS Code |

|---|---|---|

| Green (raw) coffee | Raw beans without processing | 090111 |

| Roasted coffee | Roasted, as beans or ground | 090121 |

| Instant coffee | Powder/granules ready to dissolve | 210111 |

The exact heading may vary depending on the presentation form, additives, caffeine percentage, and processing.

2) Steps for Coffee Customs Clearance

-

Order registration in the National Trade System: Importers must first register their coffee purchase order in the National Trade System. This system is one of the main requirements for importing goods into the country, and all shipment information—including the type of goods, weight, CIF value (cost of goods plus insurance and freight), and the importer’s commercial details—must be entered. Errors at this stage can lead to clearance delays and extra costs.

-

Obtaining health permits: As a food product, coffee is subject to oversight by health and quality control organizations. Therefore, importing this product requires obtaining health permits from the relevant authorities. These include product health certificates, quality standards, and compliance with national health regulations. At this stage, importers must obtain the relevant certificates from recognized authorities in the country of origin and submit them to customs along with other documents.

-

Certificate of Origin (CO): The certificate of origin is one of the essential documents in the coffee clearance process and is issued by the chamber of commerce in the country of origin. It indicates the producing country and cultivation/harvest process and is very important for identifying preferential tariffs and other matters.

-

Customs declaration: After preparing the necessary documents, importers must enter all shipment information—including coffee type, weight, CIF value, and related documents—into the customs declaration. Accuracy is vital here, since any error can cause delays in clearance.

-

Payment of customs duties and taxes: Based on the type of coffee and the level of processing, customs calculates duties and taxes. Importers must pay these amounts to clear their shipment. The more processing performed on the coffee, the higher the customs tariff applied.

-

Inspection and quality control: After paying duties and taxes, the imported goods are inspected by customs experts and relevant organizations to ensure compliance with standards and health regulations. At this stage, sampling may be carried out to verify quality and safety.

3) Special Conditions for Coffee Import and Export

Coffee imports to Iran: In recent years, coffee imports to Iran have grown significantly. As a major coffee consumer, Iran supplies a large part of its needs through imports. Brazil, Vietnam, India, and Colombia are the most important coffee exporters to Iran. Brazil, as the world’s largest producer and exporter of coffee, supplies a significant portion of Iran’s imported coffee. Thanks to the variety of coffees produced (such as Arabica and Robusta), Brazil is one of Iran’s main trade partners in this field.

Import volume to Iran: According to customs statistics, Iran imports more than 30,000 tons of coffee annually. A large share of these imports consists of green (raw) coffee that is processed in domestic factories and offered to consumers. The highest import volumes come from Brazil, Vietnam, and India. Due to dependence on global markets and price fluctuations, coffee imports are highly sensitive.

Exports from Iran: Although Iran is not known as a coffee producer, re-exporting coffee to neighboring countries—especially Iraq, Afghanistan, and the Persian Gulf states—is of special importance. These exports mainly include processed coffees such as instant coffee and coffee-derived products. Owing to its favorable geographic location and proximity to consumer markets in the region, Iran plays an important role in coffee re-exports.

4) Global Coffee Flows

Global circulation of coffee: Coffee is one of the most consumed food commodities worldwide, with more than 10 million tons produced and traded annually. The largest coffee producers include Brazil, Vietnam, Colombia, Indonesia, and Ethiopia. Brazil, as the largest producer and exporter, supplies more than 40 percent of the global market’s needs. Vietnam, focusing on Robusta production, is the second largest coffee exporter globally.

Major coffee exporters worldwide: In addition to Brazil and Vietnam, Colombia, Ethiopia, and India are among the largest coffee exporters. Thanks to suitable climates and diverse production, these countries hold a significant share in world markets. Colombia has a special position among exporters due to its high-quality Arabica.

Major coffee importers worldwide: European countries and the United States are among the largest coffee importers. Germany, Italy, France, and the United States are major consumers and import large volumes annually from producing countries. Due to coffee culture and the presence of major brands, European countries are a very large market for coffee.

5) Key Points in Coffee Clearance

Quality and health control: As a food product, coffee is under strict supervision by health organizations. The import must comply with international health and quality standards. Any non-compliance with health and quality control standards may lead to delays in clearance or even return of goods. Therefore, importers should ensure the imported product has no quality or safety issues and that all required health documents from the country of origin are provided.

Compliance with customs tariffs: Customs tariffs vary depending on the type of coffee and its level of processing. Green (raw) coffee has a lower tariff due to the lack of processing, while roasted or instant coffee, which undergo more processing, are subject to higher tariffs. Exact compliance with customs tariffs is a key point in coffee imports, helping importers calculate customs costs correctly and avoid extra expenses.

Import permits: Coffee importers must obtain the necessary permits from the relevant organizations. In addition to health permits, permits such as standard certification and quarantine approval may be required. These permits vary depending on the coffee type and country of origin and must be prepared before the goods enter customs.

6) Documents Required for Coffee Clearance

Clearing coffee from customs requires documents that, due to the food nature of this product, are highly important. These documents not only facilitate and speed up clearance but also help ensure health and quality standards.

- 1. Order registration: The first step in clearance is registering the order in the National Trade System. Importers must enter complete details about their shipment, including coffee type, weight, CIF value (goods price plus freight and insurance), and commercial details. Accuracy is crucial here because any mistake may cause issues later on.

- 2. Health certificate: Since coffee is a food product, a health certificate from the country of origin is mandatory. This certifies compliance with international health standards and the absence of contamination or health issues. Without it, coffee cannot be cleared.

- 3. Standard certificate: Usually issued by competent authorities in the country of origin, this indicates product quality and compliance with national/international standards. It is very important for ensuring quality and facilitating clearance.

- 4. Certificate of Origin: Another key document that must be issued by the chamber of commerce in the country of origin. It indicates the producing country and is used in determining customs tariffs and cross-checking other documents.

- 5. Commercial invoice: Includes details such as unit price, total shipment value, payment terms, and seller/buyer information. It is one of the main documents for calculating customs duties and taxes.

- 6. Packing list: Provides details about packaging, number of packages, and net/gross weight. This document is important for verifying that the physical shipment matches other documents.

- 7. Transport bill of lading: Issued by the carrier, it contains transport information for the shipment and helps verify transport status and its consistency with the customs declaration.

- 8. Customs declaration: At this stage, importers must accurately enter all coffee shipment details—type, weight, CIF value, and HS Code—into the customs declaration. Accuracy is vital and any error can cause delays.

- 9. Import permits: Depending on the coffee type and country of origin, special permits from relevant organizations such as the standards or health authorities may be required. These must be obtained before the goods enter customs.

- 10. Cargo insurance policy: Shows that the shipment was insured during transport. It is presented to cover possible losses in case of incidents or damage.

- 11. Quarantine permit: In some specific cases—especially for products entering from certain regions—a quarantine permit is required, confirming the product is free of diseases or pests.

- 12. Pre-shipment inspection certificate: In some cases, customs requires a pre-shipment inspection certificate confirming that the coffee shipment was inspected and approved by a recognized organization before dispatch to the destination country.

Need an exact HS Code and a landing-cost estimate? Our team manages the process end-to-end.

Submit a Proforma RequestKey Tips and Practical Recommendations

- Before purchase, obtain exact specifications (bean type, moisture percentage, caffeine, additives) to determine the correct HS Code.

- Make Pre-Shipment Inspection and CO mandatory in the purchase contract.

- For instant coffee, consider how packaging (sachets/jars/cans) affects import duties and Persian labeling from the outset.

- Proceed with order registration and preparation of health documents in parallel to minimize customs delays.

- Compare different origin scenarios and freight rates to optimize landed cost.

Frequently Asked Questions

What are the HS Codes for coffee types?

Green coffee 090111, roasted coffee 090121, and instant coffee 210111; the exact heading may change depending on processing/additives.

Which documents are essential for coffee clearance?

Order registration, invoice and packing list, CO, health/standard certificates, bill of lading, customs declaration, cargo insurance, and import/quarantine permits.

Which countries are the main suppliers of Iran’s imported coffee?

Brazil, Vietnam, India, and Colombia are among the most important exporters of coffee to Iran.

Are inspection and sampling performed on coffee shipments?

Yes. After paying import duties, sampling and quality/health checks may be performed by the relevant authorities.

Special Coffee Clearance Services by Saba Brokerage

With extensive experience in import/export clearance, Saba Brokerage provides comprehensive, specialized services for clearing all types of coffee—from order registration to final delivery to the customer. Key services include:

- Expert consulting on tariffs and customs regulations: Our professional team, fully versed in customs rules and tariffs for different coffees, advises importers so they can clear shipments confidently without customs issues.

- Pursuing and obtaining health permits: We handle all steps of obtaining health and customs permits from the relevant authorities on behalf of clients, including health certificates, quality standards, and other required approvals.

- Order registration and customs declaration: Our team quickly and accurately registers coffee shipment information in the National Trade System and the customs declaration to prevent delays or issues.

- Inspection and delivery: From entry into customs to final delivery, we closely track all clearance steps to ensure the goods are delivered as soon as possible and under the best conditions.

- Cost reduction and process optimization: Leveraging deep expertise, we offer solutions to reduce customs costs and accelerate clearance so clients can manage imports smoothly.

For more information, get in touch with our experts.

.png)