Pickled Goods Customs Clearance | Complete Guide by Saba Tarkhis

For estimating the time and cost of pickled goods clearance, contact the experts at Saba Tarkhis.

Free Consultation for Pickled Goods Clearance

Detailed Description of Pickled Goods and Technical Features

Definition and Common Ingredients of Pickled Goods

Types and Applications

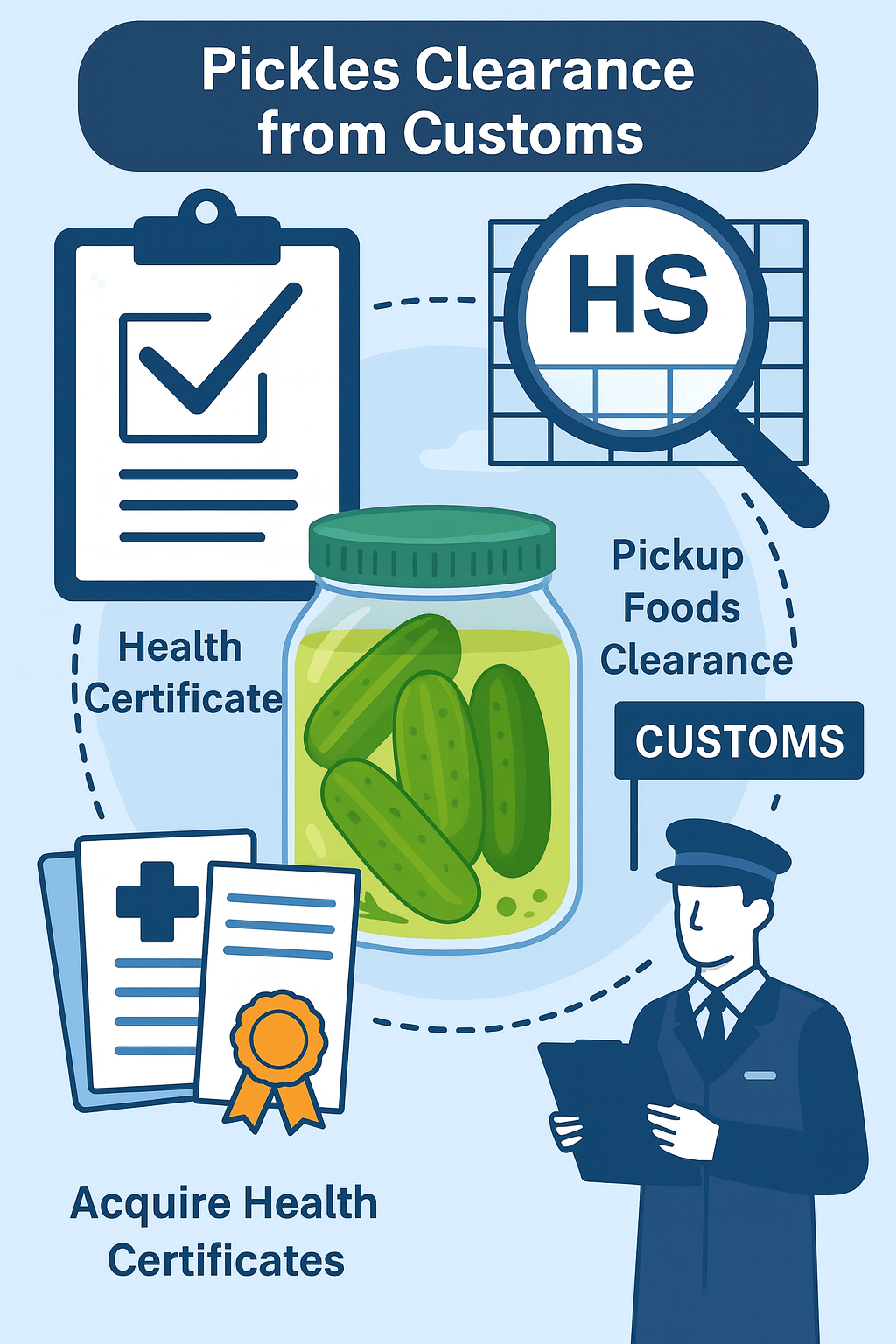

Customs Clearance and Regulations

Key Points in Clearance, Permits, and Health Standards

- Label inspection: ingredients list, production/expiry date, batch number, net/gross weight, country of origin.

- Compliance of shipping documents with commercial documents to avoid discrepancies.

- Health sampling if required and submission of valid laboratory results.

Customs Tariff / HS Code for Pickled Goods

| HS Code (Sample) | Description / Example |

|---|---|

| 2001.10 | Pickled cucumbers in vinegar/acetic acid (general example) |

| 2001.90 | Other vegetables/fruits in vinegar/acetic acid (mixed pickles) |

| 2005.70 | Olives prepared/preserved other than vinegar/acetic acid (common example) |

For certain specific products such as brined olives or pickled tomatoes, separate subheadings may apply. Choosing the correct code prevents value disputes, miscalculations, and delays.

Special Conditions for Import and Export of Pickled Goods

Market and Trade of Pickled Goods

Required Documents for Clearance

- Commercial Invoice: type of pickle, quantity, unit/total price, seller/buyer, payment terms, and transaction date.

- Bill of Lading: origin/destination, mode of transport, number of packages, weight, and type of packaging.

- Certificate of Origin: issued by the chamber of commerce in the origin country to ensure proper tariff application.

- Health Certificate: confirmation of compliance with the destination country’s hygiene standards.

- Import permit from the Food and Drug Administration: evaluation of documents and product sample prior to issuance.

- Standard Certificate: compliance with national/international standards in terms of quality, packaging, and hygiene.

- Customs Declaration: specifying type, weight, quantity, value, and the exact HS Code.

- Packing List: quantity, type of packages, net/gross weight, and traceability.

- Cargo insurance policy: coverage of potential damages during transportation.

Clearance Method (Simple, Fast, and Safe) + Saba Tarkhis’ Special Brokerage Services

- Pre-review of product and HS code; matching ingredients/label with Iranian requirements.

- Preparing a document checklist (invoice, packing list, certificates of origin/health, required permits).

- Order registration and FX allocation (if needed), coordination of transport and insurance.

- Customs declaration, inspection acceptance, and sampling (upon request of relevant authorities).

- Calculation of import duties and payment of statutory charges.

- Release, seal breaking, final valuation, and cargo exit.

Need an exact HS Code and permit consulting? Our team manages the case end-to-end.

Request a Cost & Lead-Time Estimate.png)

Frequently Asked Questions

What is the HS code for pickled cucumbers?

Depending on preparation, they usually fall under 2001.10 when in vinegar/acetic acid; for “other than vinegar/acetic acid,” subheadings under 2005 are considered.

Is a Health Certificate mandatory for importing pickled goods?

Yes. A Health Certificate issued by a competent authority in the country of origin and approval by Iran’s Food and Drug Administration are required.

What permit is required for pickles containing animal-derived ingredients?

In addition to the Food and Drug Administration permit, a permit from the Veterinary Organization is also mandatory.

How long does pickled goods clearance take?

It varies based on document completeness, test results, customs workload, and label compliance. Completing documents and accurate coding reduce the time.

Saba Brokerage’s Special Services for Pickled Goods Clearance

As one of the most reputable and professional customs brokers, Saba Brokerage offers special services in the clearance of pickled goods. With extensive experience in foodstuff clearance and full knowledge of customs rules and regulations, this brokerage assists importers and exporters throughout all clearance stages. Some of the key services Saba offers to its clients include:

Specialized Consulting

The expert team provides professional consulting on customs regulations, hygiene standards, and required documentation to help importers and exporters complete all clearance steps smoothly and successfully.

Preparation and Submission of Required Documents

Leveraging experience in preparing and submitting all necessary documents including Health Certificates, commercial invoices, bills of lading, and certificates of origin ensures everything is prepared on time and submitted to customs authorities.

Coordination with Government Agencies

Strong relationships with agencies such as the Food and Drug Administration and the Ministry of Health expedite the issuance of necessary import and export permits for pickled goods.

Accurate Calculation of Customs Duties

Accurate calculation of clearance costs and customs duties is a vital service that helps reduce expenses and optimize the import process.

Clearance Process Follow-Up

The team continuously follows up on all clearance stages and provides transparent, up-to-date reports to keep clients informed of progress.

Optimized Transport Solutions

By offering the best domestic and international transport solutions, your food products are delivered to the final destination with quality and speed.

.png)