Customs Clearance of Various Juicer Machines in Iran (HS Code + Documents and Standards)

For estimating the time and cost of customs clearance of juicer machines (home/semi-industrial/industrial), contact the experts at Saba Tarkhis.

Instant and Free Consultation

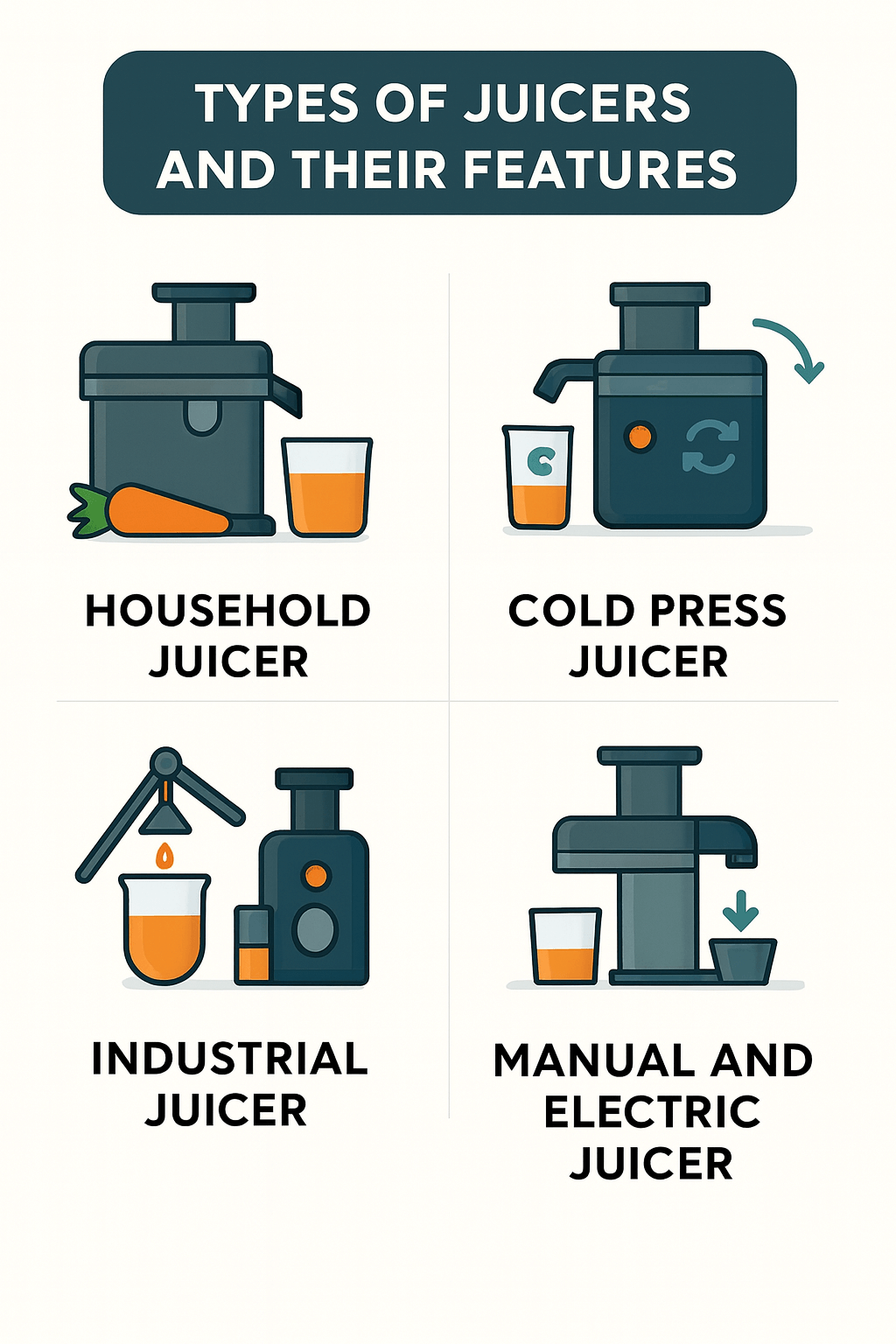

1) Types of Juicer Machines and Their Features

Household Machines: These machines are designed for personal use at home and allow users to prepare fresh and healthy juices on a small scale.

Manual and Electric Machines: Manual juicers are designed for simple household applications, while electric machines—with more features and higher efficiency—are used for more professional purposes.

Centrifugal and Cold-Press Machines: Centrifugal juicers separate the juice from the pulp using centrifugal force. In contrast, cold-press machines, which employ more advanced technology, extract the juice through mechanical pressure; and due to the absence of heat, all vitamins and nutrients in the fruits are preserved.

2) Applications of Juicer Machines

Home Use: Many families use juicers to prepare healthy and fresh beverages at home. These machines enable consumers to easily and in the shortest possible time make different juices, smoothies, and mixed drinks.

Food and Beverage Industries: In large beverage-production industries, industrial juicers play a key role in the production process. With high capacity and desirable efficiency, they make possible the mass production of various packaged juices.

Restaurants, Hotels, and Cafés: In these venues, juicer machines are used to offer customers fresh and healthy drinks—especially cold-press machines, which are highly regarded due to preserving vitamins and the natural taste of fruits.

Organic Beverage Production: Given the rising demand for organic and natural products, cold-press juicers are used as essential tools in this industry. They allow producers to offer beverages with the highest quality and maximum nutrient retention.

3) Key Points in Customs Clearance of Juicer Machines

Customs Tariff (HS Code)

Compliance with Standards

Required Documents for Clearance

1. Commercial Invoice

The invoice must include complete and accurate details of the juicer machine purchase. This includes the supplier’s name and details, purchase date, invoice number, machine type, quantity, and price. The invoice should be issued in English or the origin country’s language and confirmed by the seller. This document helps customs verify the value of the goods and ensure the declared amounts align with actual prices.

2. Bill of Lading

The bill of lading is a document that contains information related to the transportation of the juicer machine. It must include shipment details, the carrier’s name, bill of lading number and date, and precise cargo specifications. It helps customs confirm evidence of shipment and separate the type and quantity of goods upon import.

3. Certificate of Origin

The certificate of origin confirms the country where the juicer machine was manufactured. It must be issued by the chamber of commerce of the producing country and confirmed by the related embassy or consulate. This certificate is important for determining customs tariffs and benefiting from international trade agreements.

4. Health and Safety Certifications

Juicer machines—especially when used industrially—must meet hygiene and safety standards. For importing these machines, you need health approvals from supervisory organizations such as the Food and Drug Administration (or its equivalent in the origin country). These approvals should be presented to customs to ensure the imported machines comply with health and safety standards.

5. Special Permits

In some cases—particularly for industrial machines or those subject to specific regulations—special permits are required from supervisory bodies such as the Department of Environment or the National Standards Organization. These may include environmental assessments or additional approvals for use in specific industries.

Technical Evaluation of Machines

4) Import and Export Conditions for Juicer Machines

5) Volume of Imports and Exports of Juicer Machines

| Goods | Short Description | HS Code |

|---|---|---|

| Juicer machine (household/semi-industrial/industrial) | Extracting juice from fruit/vegetables; centrifugal/cold-press | 8435.10 |

Exact classification depends on power/manual operation, capacity, application (household/industrial), accessories, and country of origin.

Need precise HS 8435.10 classification, standards/health approvals, and document preparation? Our team manages the process end-to-end.

Submit Proforma Request

Frequently Asked Questions

What is the HS Code for juicer machines?

According to your text, juicer machines are classified under 8435.10; final determination depends on features/application.

Which permits are required for import?

Approval from the national standards body, health/compliance permits (Ministry of Health/Food and Drug Administration or equivalent), and, if necessary, specific environmental/standards permits.

What are the key documents for clearance?

Commercial invoice, bill of lading, certificate of origin, health/safety certificates, special permits (if needed), declaration, and other documents stated in the text.

Special Customs Clearance Services by Saba Brokerage

To facilitate the customs clearance of juicer machines, using the services of an experienced customs broker who is knowledgeable about relevant laws and regulations is of particular importance. As one of the most reputable customs brokers in Iran—with years of experience in clearing various industrial and household equipment, including juicer machines—Saba Brokerage provides comprehensive services to importers.

Specialized Consultation: Providing expert advice on selecting the appropriate tariff code, calculating customs costs, and preparing the required documents for clearance—accurately and professionally.

Follow-up on Documents and Permits: Following up and obtaining all necessary permits from supervisory and health organizations for clearing juicer machines and other goods so that the clearance process proceeds quickly and without issues.

Technical Evaluation and Compliance with Standards: Conducting precise evaluations of machines and goods, ensuring their compliance with national and international standards, and expediting the clearance process.

Negotiation on Customs Valuation: Conducting necessary negotiations with customs experts to determine the valuation of goods, aiming to reduce customs costs and facilitate clearance.

Fast and Reliable Clearance: Providing fast and reliable clearance services in the shortest possible time—especially for goods that require urgent clearance.

Post-Clearance Services: After clearance, services such as transporting the goods to the final destination and consultation on re-export are also provided.

By using these services, you can benefit from the team’s experience and knowledge and carry out the import and clearance of juicer machines and other goods in the best and simplest possible way. With a focus on customer satisfaction and quality services, this team will accompany you from document preparation to final clearance of the goods.

.png)