Customs Clearance of Carbon Filter (Activated Carbon) in Iran | HS Code 3802.10

To estimate the time and cost of customs clearance for carbon filters (activated carbon), contact the Saba Tarkhis experts.

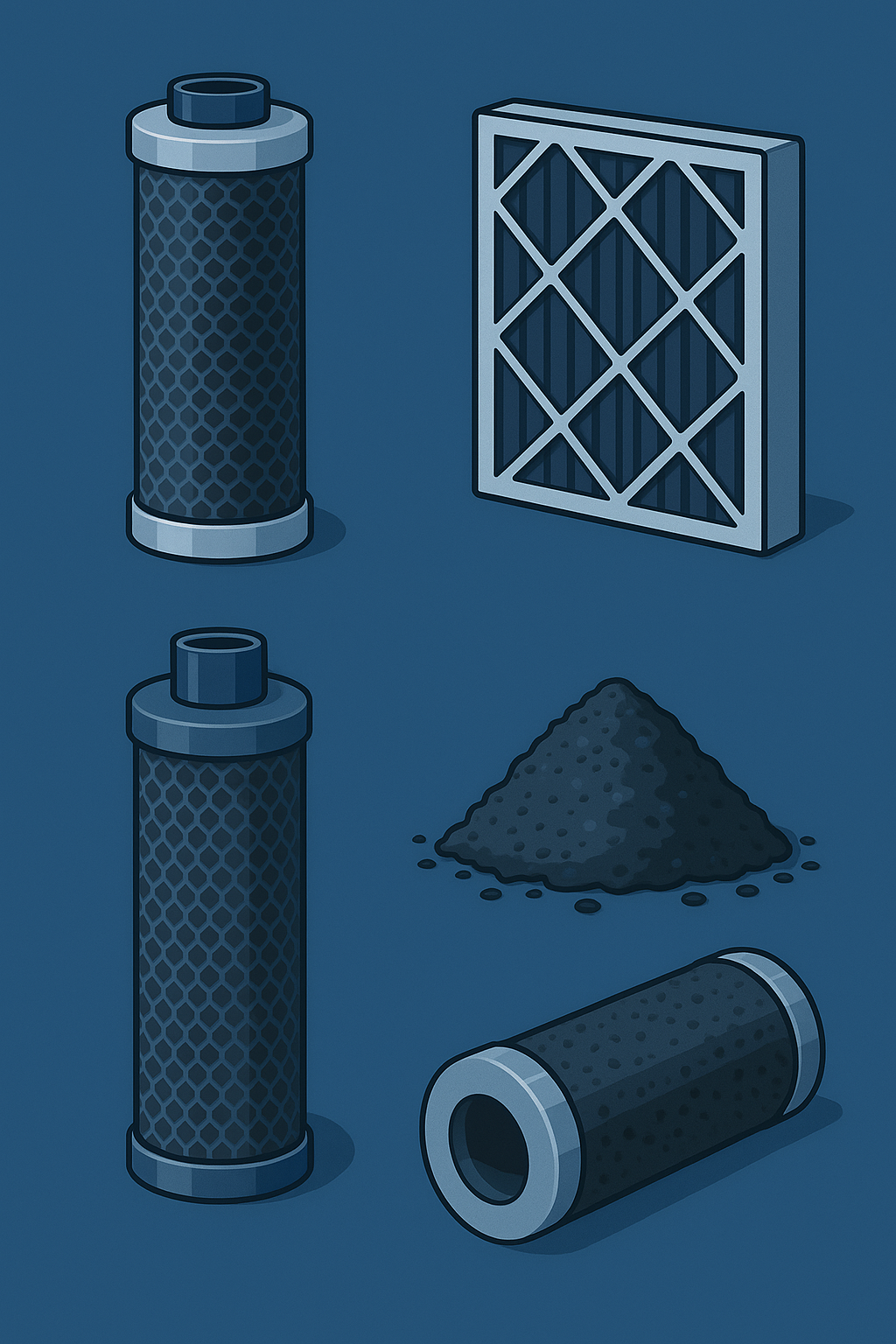

Instant Free Consultation1) Specialized Applications of Carbon Filter (Activated Carbon)

- Water treatment: Activated carbon is widely used in water treatment systems to remove chemical contaminants, heavy metals, chlorine compounds, and suspended organics. Acting as a very strong adsorbent, it improves water quality. Using activated carbon in treatment systems helps lower operating costs and increase purification efficiency.

Air purification: Activated carbon in air filters is used to remove unpleasant odors, toxic gases, and particulates. Its microporous structure rapidly adsorbs air pollutants and significantly enhances indoor air quality. These filters are common in air purifiers and industrial HVAC.

Chemical & petrochemical industries: In gas/liquid separation and refining, activated carbon plays a key role in adsorbing and removing undesirable organic and chemical compounds. It is crucial in purification for product quality especially in petrochemicals.

Pharmaceutical & food industries: Activated carbon is used to remove impurities, unwanted colors, contaminants, and harmful compounds from products. Its use helps deliver higher-quality outputs in these regulated industries.

2) Key Notes for Clearing Activated Carbon

Due to sensitive applications and various legal requirements, clearing activated carbon involves specific steps and documentation. Below are some of the most important points and stages:

Customs tariff (HS Code): Activated carbon is usually classified under 3802.10. Choosing the correct tariff code is critical for accurate duty calculation and avoiding clearance delays. Experienced tariff specialists can help select the correct heading.

Quality & safety certificates: Because activated carbon is used in sensitive sectors like water and air purification, providing quality certificates from recognized authorities is mandatory. These confirm the imported product meets the required standards for various industries.

Technical evaluation & testing: Some customs houses may require specialized product testing before clearance. These tests confirm conformity with national/international standards. Preparing and sending samples to accredited labs may be part of the process and, without proper planning, can cause delays.

3) Customs Tariff and HS Code

| Goods | Description | HS Code |

|---|---|---|

| Activated carbon | Used in water/air treatment, chemical industries | 3802.10 |

The exact subheading depends on purity, grade, and packaging type.

4) Import and Export Conditions for Activated Carbon

Import conditions into Iran

Iran, driven by strong demand (especially in water/air treatment), is a major importer. Main sources include China, Germany, the United States, and Japan—countries that supply high-quality products using advanced technology.

High demand in water/air treatment, pharma, and chemicals leads Iran to import large volumes annually—one key reason being the growth of treatment and processing industries.

Exports from Iran

Although domestic production is significantly lower than imports, Iran does export activated carbon from certain industrial units to regional markets such as Turkey, Iraq, and other neighbors. Proximity favors limited-volume shipments.

Domestic capacity has not yet reached broad export levels; hence export volumes remain much smaller than imports.

Import/export volumes for Iran

Given rising domestic demand, annual imports are estimated at several thousand tons—supplying water/air treatment, petrochemicals, and dependent sectors. The uptrend reflects growing demand and industrial process improvements.

Conversely, exports in recent years have not exceeded a few hundred tons. Though production is growing, capacity is still insufficient for large-scale exports.

Global market

The global activated carbon market has grown markedly in recent years. Increasing needs in water/air treatment, pharma, food, and chemicals have boosted trade volumes.

According to global estimates, the market value could reach several billion dollars by 2025, driven by population growth and the need to improve water/air quality. Stricter environmental rules in industrialized countries also lift demand.

Top exporting countries

China, the United States, Germany, India, and Japan are among the largest producers/exporters—recognized leaders thanks to advanced technology and strong industrial bases. China, as the biggest producer, holds a major export share with competitive pricing and quality.

Top importing countries

In contrast, Iran, Turkey, Saudi Arabia, the Gulf states, and many developing countries are major importers, annually buying significant quantities due to growing treatment industries and quality-of-life initiatives.

5) Required Documents for Clearance

- Clearing activated carbon from customs—given its broad, sensitive industrial uses—requires compliance with regulations and specific documents. Importers must present the necessary paperwork to verify quality and legal conformity.

1. Bill of Lading

A primary transport document listing cargo type, number of packages, weights, and destination. Customs require it to identify the shipment and confirm lawful carriage.

2. Commercial Invoice

A key document stating the price and value of the goods. It’s used to calculate duties/taxes and must include precise details of the transaction and product.

3. Certificate of Origin

Confirms the exporting country. May affect duty rates/import conditions, especially where trade agreements with Iran exist.

4. Certificate of Conformity (Standard)

Issued by a recognized body to confirm quality. Ensures the imported activated carbon meets required standards for sensitive uses like water/air treatment.

5. Health & Safety Certificate

Since activated carbon is used in sanitary/purification applications, a health certificate issued by authorities in the country of origin is required, confirming the product’s safety.

6. Import Declaration

Submitted by the importer or legal representative, containing product specs, customs value, and transaction details.

7. Packing List

Detailed information on package types/counts, net/gross weight, and packing method—used by customs to verify the shipment.

8. Import License

Depending on application/type, specific permits may be required from bodies such as the National Standards Organization, Environmental Organization, and Ministry of Health—showing the import is legally supervised.

9. HS Code

Activated carbon is usually 3802.10. Accurate classification is vital to calculate duties and avoid clearance issues. Misclassification can cause delays or extra costs.

10. Inspection Certificate

In some cases—especially for sensitive applications—customs may require an inspection certificate from an accredited entity confirming conformity with set standards.

11. Order Registration in Iran Trade Single Window

Must be completed prior to import arrival to align with trade policy and quota management.

12. Energy Certificate

Where the product is used in energy-related industries, an energy certificate may be required—confirming efficiency and environmental compatibility.

Need precise HS Code selection and document preparation? Our team manages the case end-to-end.

Request a Proforma

Frequently Asked Questions

What is the HS Code for carbon filters?

Activated carbon is classified under 3802.10.

Which documents are required for clearance?

Bill of lading, commercial invoice, certificate of origin, quality certificate, health certificate, import declaration, and import license.

Who are the main exporting countries?

China, the United States, Germany, India, and Japan are among the largest producers and exporters.

Specialized Clearance Services by Saba Brokerage

With years of experience in clearing industrial and consumer goods including activated carbons our brokerage has earned a strong standing in Iran. We provide expert guidance throughout every stage, from order registration to final delivery, in a specialized and optimized manner.

Key services for activated carbon clearance include:

Expert tariff classification: Given the complexity of classification, our seasoned specialists select the best HS code to precisely calculate duties and taxes and prevent potential issues.

Preparing and submitting required certificates and documents: We handle essential paperwork health, standards, and quality certificates quickly and accurately so clearance proceeds smoothly.

Coordinating technical tests and obtaining customs approvals: Where testing and approvals are required, we manage end-to-end follow-up to ensure conformity with applicable standards.

Expediting clearance: Leveraging professional relationships and deep knowledge of customs workflows, we minimize time and extra costs.

With a fully professional approach and modern methods, we support you through every step and help avoid delays and potential problems.

.png)