Customs Clearance of Plastic Polymers from Iranian Customs (HS Codes + Documents and Tariffs)

To estimate the time and cost of clearing plastic polymers (PE/PP/PS/PVC), contact the experts at Saba Tarkhis.

Instant Free Consultation1) Applications of Plastic Polymers

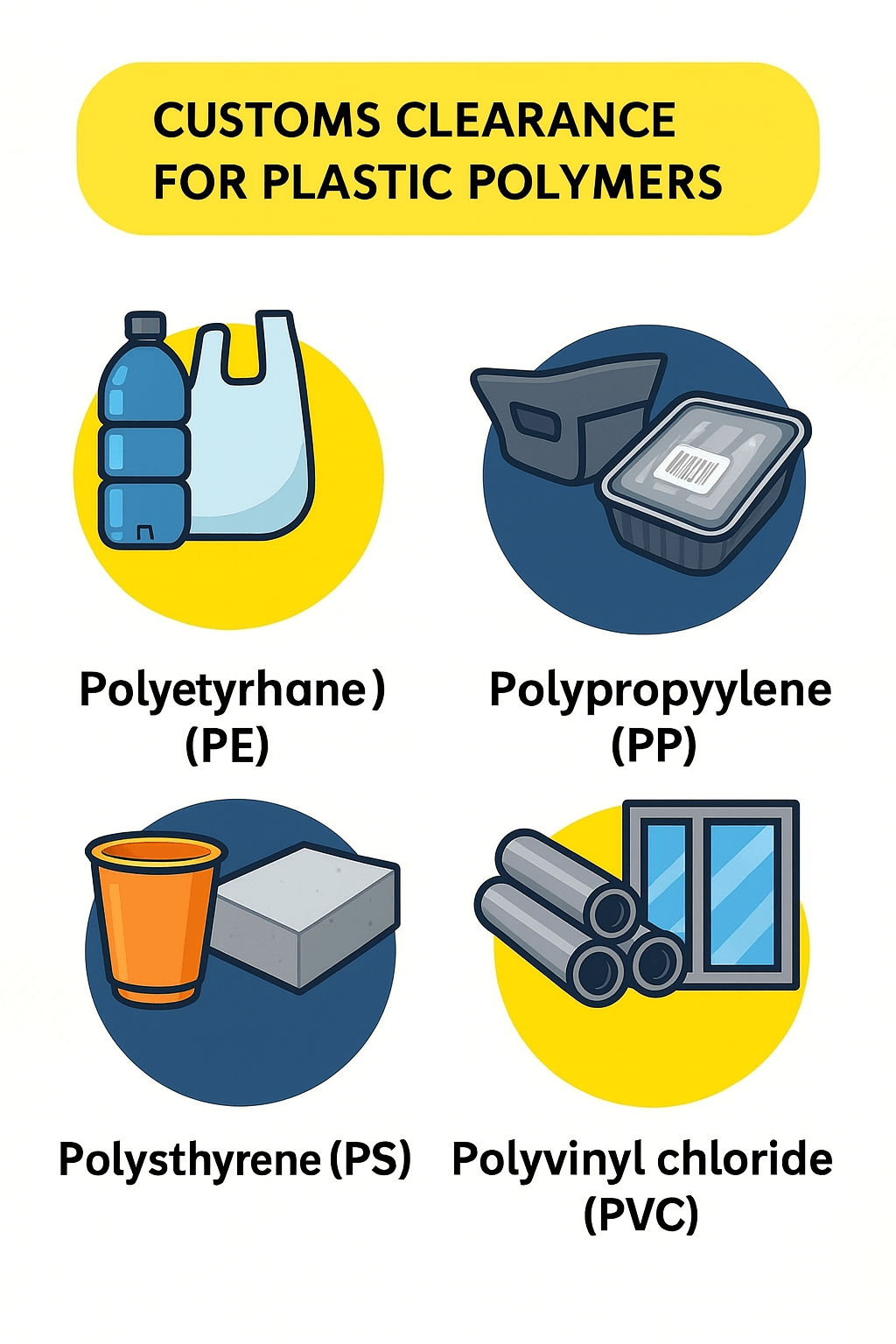

Polyethylene (PE)

Polypropylene (PP)

Polystyrene (PS)

Polyvinyl Chloride (PVC)

2) Key Points for Clearing Plastic Polymers from Customs

Accurate identification of the customs tariff code (HS Code): Each type of plastic polymer has a specific HS code based on which duties and taxes are determined. For example, polyethylene is HS 3901, polypropylene is 3902, polystyrene is 3903, and polyvinyl chloride is 3904. Selecting the correct tariff code for each polymer prevents problems during clearance and facilitates the process.

Submission of essential documents: The documents required for clearing plastic polymers include the commercial invoice, packing list, bill of lading, and certificate of origin. In addition, where needed, national or international standard certificates and product quality approvals must be provided to ensure compliance with required standards.

Customs valuation: The customs value of plastic polymers is determined based on purchase price in the country of origin, transportation costs, insurance, and other related expenses. This value forms the basis for calculating customs duties and taxes. Accurate valuation is crucial for precise cost estimation and to avoid potential disputes with customs.

Quality control and standards: Imported plastic polymers must comply with national and international standards. Some types, due to sensitive applications in medical or food industries, may require specific approvals from the Institute of Standards and Industrial Research of Iran. These approvals ensure that imported products meet satisfactory quality and hygiene levels.

Review and compliance with import regulations: Import regulations for plastic polymers may vary depending on the product type and application. For example, imports of polymers used in medical products may be subject to special rules requiring permits from the Ministry of Health. Awareness of and compliance with these regulations are essential in the import process.

Checking the need for order registration: Some polymers require order registration in the Ministry of Industry, Mine and Trade system. This must be completed prior to import and necessary approvals obtained to ensure the goods enter customs without issues.

| Polymer Type | Key Application | HS Code |

|---|---|---|

| Polyethylene (HDPE/LDPE) | Film and bags, bottles, pipes | 3901 |

| Polypropylene (PP) | Industrial parts, food packaging | 3902 |

| Polystyrene (GPPS/HIPS) | Disposable containers, foam, insulation | 3903 |

| Polyvinyl Chloride (PVC) | Pipes, profiles, cable sheathing | 3904 |

The exact subheading depends on resin grade, form (pellet/powder), additives, and end-use.

3) Customs Tariffs and HS Codes for Plastic Polymers

Polyethylene (PE) — HS Code 3901:

Polyethylene is one of the most widely used plastic polymers in the world. Due to physical properties such as high impact resistance and chemical resistance against acids and bases, it is used to produce films, bags, bottles, and pipes.

Depending on the type of polyethylene (high density, low density, or linear), customs tariffs may vary. These tariffs are usually between 5% and 10% of the goods’ value. For example, HDPE may have a different tariff than LDPE.

Value Added Tax (VAT): In addition to customs duty, imported polyethylene is subject to VAT (generally 9%), calculated on the total value after applying customs duty.

Polypropylene (PP) — HS Code 3902:

Polypropylene is a semi-crystalline polymer that, due to unique features like high heat resistance and chemical resistance, is used to make various products including automotive parts, medical equipment, and food packaging.

Customs duty for PP, depending on its specific type (e.g., homopolymer or copolymer), may be around 7% to 12% of the goods’ value. The application and production process may also influence the tariff.

VAT: Like polyethylene, polypropylene is also subject to VAT, applied on the customs value plus customs duties.

Polystyrene (PS) — HS Code 3903:

Polystyrene is an amorphous polymer with suitable mechanical properties. Owing to its light weight and insulation features, it is used in disposable containers, foam packaging, and thermal and acoustic insulation.

Customs tariffs for PS can vary between 6% and 13%. Different types such as HIPS and GPPS may face different tariff rates.

VAT: Imports of polystyrene are also subject to VAT, calculated on the final value after applying customs duty.

Polyvinyl Chloride (PVC) — HS Code 3904:

PVC is a rigid polymer resistant to environmental conditions, mainly used in the construction industry for producing pipes, door and window profiles, and flooring. It is also used in the medical and food packaging industries.

Customs duty for PVC imports is usually in the range of 8% to 15% of the goods’ value. Differences may depend on the type of PVC (e.g., flexible or rigid) and the country of origin.

VAT: Like other polymers, PVC imports are subject to VAT, which is added to the final customs value.

4) Factors Affecting Customs Tariffs

Country of origin: Tariffs may differ based on bilateral or multilateral trade agreements with origin countries. For example, imports from countries with free trade agreements with Iran may face lower tariffs.

Type of application: Some polymers used for specific applications such as medical equipment or food-contact products may be subject to special tariffs or duty exemptions, often set as supportive policies for critical industries.

Environmental regulations: In certain cases, polymers with adverse environmental impacts may be subject to additional tariffs or green taxes. Such regulations encourage the use of more sustainable materials and reduce environmental impacts during production and consumption.

Domestic production capacity: Tariffs may be adjusted to protect domestic industries. If a polymer is produced domestically and imports could harm the local industry, higher tariffs may be imposed.

5) Main Exporting and Importing Countries of Plastic Polymers

China: the largest producer and exporter of plastic polymers to Iran.

South Korea: another key supplier of high-quality polymers.

India: one of the exporters of lower-priced polymers to Iran.

Turkey: due to geographic proximity, a key trade partner for polymer imports to Iran.

Conversely, thanks to the development of the petrochemical industry, Iran exports part of its production to neighboring countries and other regions. Polyethylene and polypropylene are among Iran’s export products shipped to Turkey, Iraq, Afghanistan, and some Central Asian countries.

6) Volume of Imports and Exports of Plastic Polymers

Need precise HS identification, tariff estimation, and document preparation? Our team manages the process end to end.

Request a Proforma Estimate.png)

Frequently Asked Questions

What are the HS Codes for the main polymers (PE/PP/PS/PVC)?

In order: 3901 for PE, 3902 for PP, 3903 for PS, and 3904 for PVC. Final determination depends on grade, additives, and form of supply.

What documents are required to clear polymer resins?

Commercial invoice, packing list, bill of lading, certificate of origin; as applicable, standard/analysis certificates and health permits for sensitive applications (food/medical).

How are VAT and tariffs calculated?

Tariff is based on HS and CIF value; then VAT (typically 9%) is applied on the value after import duties. Rates vary by grade and origin.

Specialized Customs Services for Plastic Polymers by Saba Brokerage

With years of experience in customs clearance, our team is ready to provide tailored services to importers and exporters of plastic polymers. Our services include:

Expert consulting: Our experienced team, fully aware of customs laws and regulations, guides you to choose the best clearance strategies and reduce costs. We help you optimize the import process by selecting the most suitable approaches.

Fast follow-up: Leveraging extensive networks and proven experience, we complete your customs clearance in the shortest possible time. Our goal is quick, hassle-free delivery of your goods to their destination.

Order registration services: We offer online order registration and coordination with customs experts to speed up imports. These services help you move through the steps effectively and without delay.

Inspection and quality control: Cooperation with accredited laboratories ensures your imported goods comply with required standards. This guarantees alignment with national and international norms.

Complete document management: From preparation to submission of required documents for clearance, all stages are handled by our professional team. We meticulously follow all administrative and customs procedures so you have no concerns.

For more information, please contact our experts.

.png)