Customs clearance of mono-, di-, and trimethylamine from Iran Customs (HS Code + documents and permits)

To estimate the time and cost of clearing mono-, di-, and trimethylamine, contact the Saba Tarkhis experts.

Instant free consultation1) Introduction to mono-, di-, and trimethylamines and key applications

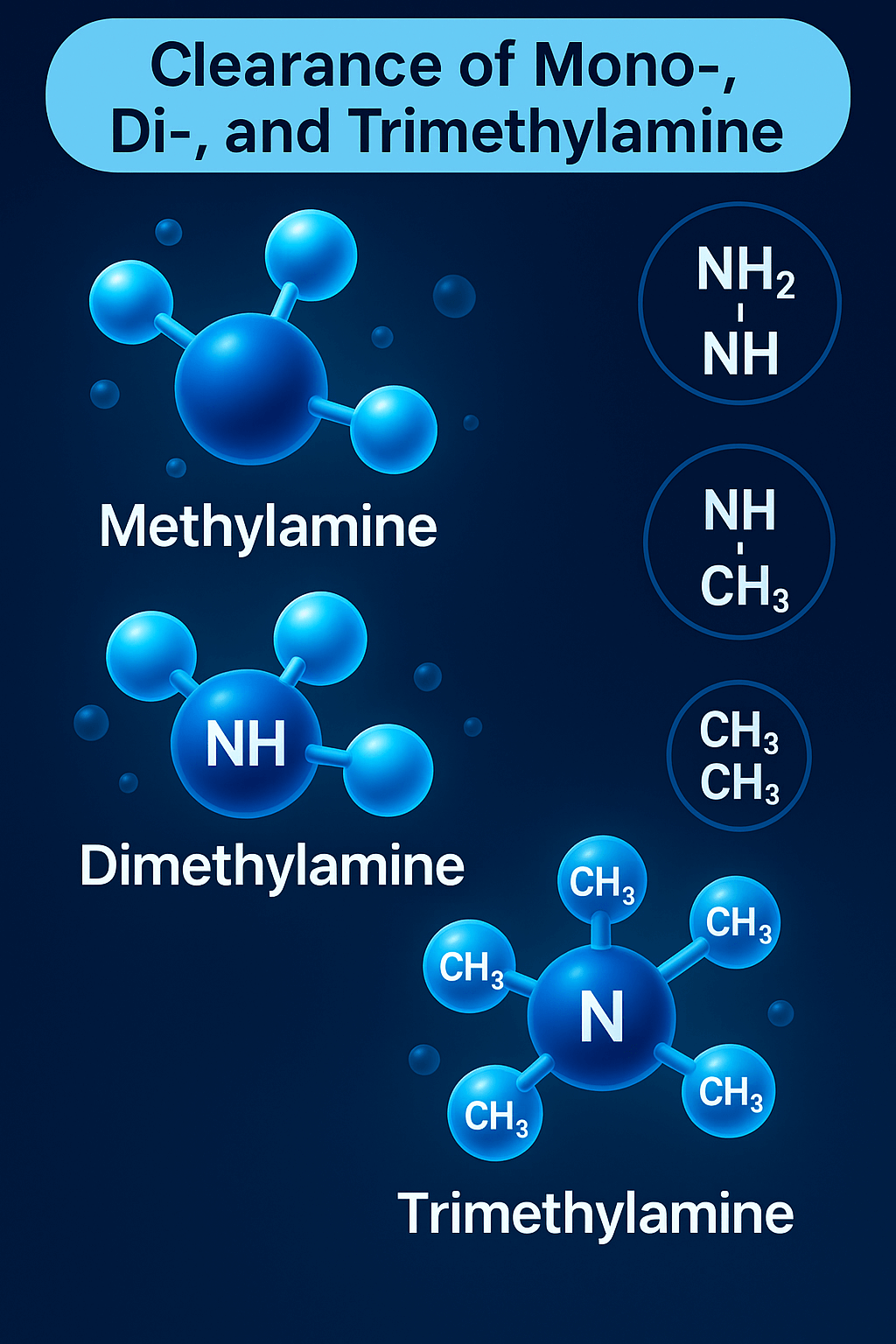

Methylamine (MMA): This compound serves as an important chemical intermediate in producing insecticides, disinfectants, and preservatives. Methylamine also plays a significant role in producing pharmaceutical and agricultural raw materials and is directly used in synthesizing many key chemical compounds.

Dimethylamine (DMA): This chemical is mainly used as a feedstock in producing cosmetics and personal care products, detergents, solvents, and resins. It also plays an important role in producing specific drugs and pharmaceutical intermediates. Due to its solubility and high stability, DMA holds an important position in manufacturing various chemicals.

Trimethylamine (TMA): This compound is used primarily in the pharmaceutical industry and in producing chemical additives. Trimethylamine is also used in manufacturing food preservatives, protective agents, and other related chemicals and, due to its high reactivity, is important in producing many specialized chemical products.

2) HS Codes for mono-, di-, and trimethylamines

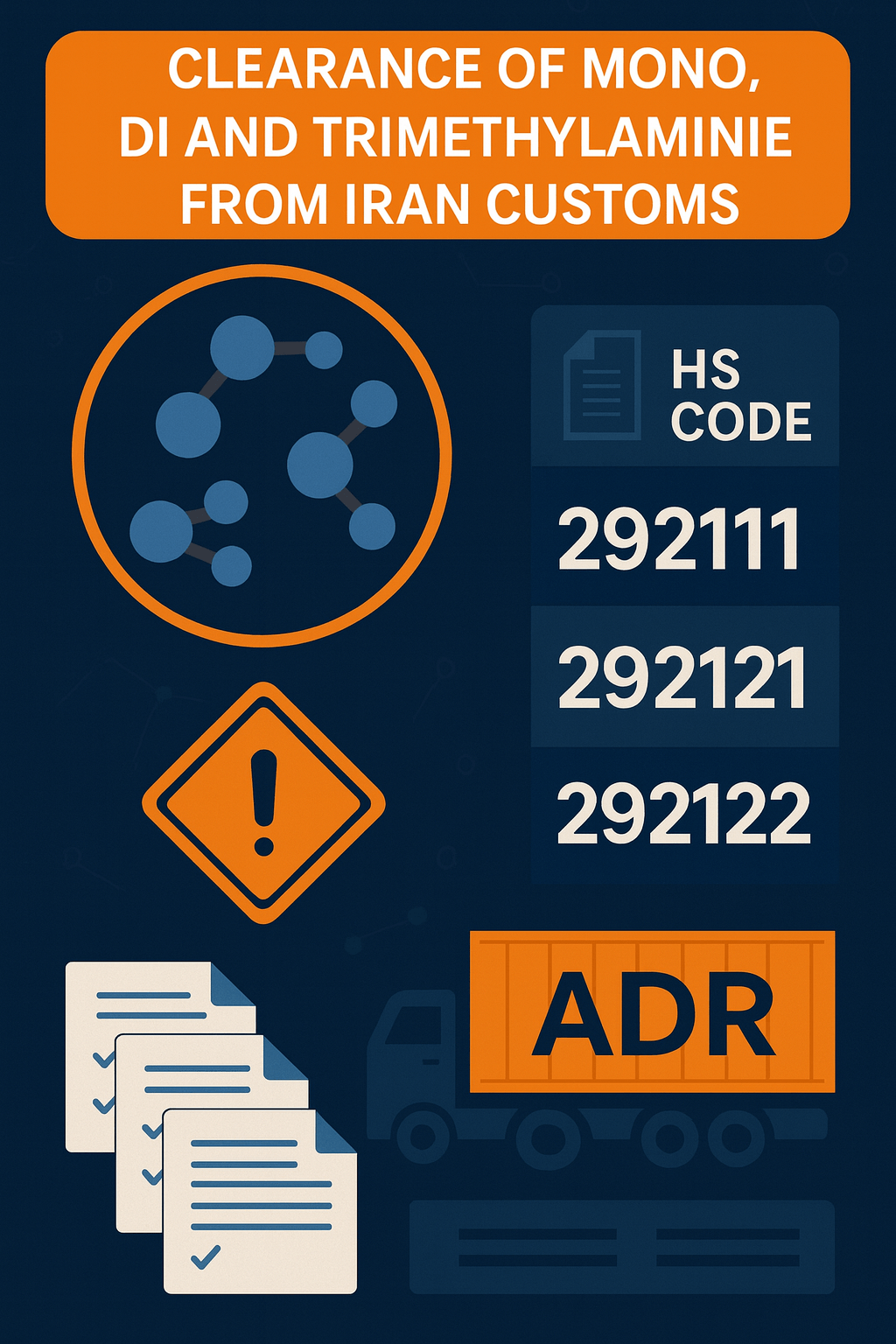

HS Codes for mono-, di-, and trimethylamines For importing and exporting mono-, di-, and trimethylamines to Iran, each of these chemicals has its own specific HS Code used for allocating customs tariffs and classification in international systems:

Methylamine (MMA): HS Code: 292111

Dimethylamine (DMA): HS Code: 292121

Trimethylamine (TMA): HS Code: 292122

Using these codes in the import and export process is essential to ensure that goods are correctly registered and classified in the customs system. These codes help countries determine and levy precise customs tariffs based on the type of goods.

| Item | Short description | HS Code |

|---|---|---|

| Methylamine (MMA) | Chemical intermediate for insecticide/disinfectant/drug | 292111 |

| Dimethylamine (DMA) | Used in detergents/solvents/resins and pharma | 292121 |

| Trimethylamine (TMA) | Chemical additive, food preservative, pharma | 292122 |

Final classification depends on grade, purity, physical state, packaging, and declared end-use.

3) Specific conditions for importing and exporting mono-, di-, and trimethylamines

4) Import requirements for mono-, di-, and trimethylamines into Iran

Necessary permits from relevant bodies: The first and most important step for importing these materials into Iran is obtaining the required permits from competent authorities. Since mono-, di-, and trimethylamines fall under dangerous goods, importers must obtain relevant permits from various bodies such as the Ministry of Health, the Department of Environment, and the National Standards Organization. These permits are issued to control safety and prevent harmful environmental impacts.

Providing safety documentation: Due to the potential risks these substances may pose to health and the environment, providing a Material Safety Data Sheet (MSDS) is mandatory. This sheet includes information on the physical and chemical properties of the substances, safe handling, and methods to manage potential hazards.

International transport regulations: Because of their hazardous chemical nature, these materials must be transported under the international ADR regulations for dangerous goods. These rules include proper packaging, labeling, and handling procedures to prevent any potential risk during transport.

Customs tariff and order registration: Importers must register the specified customs tariffs (HS Codes) for each category of mono-, di-, and trimethylamines in the customs systems and accurately enter all product information in the Comprehensive Trade System. Precise product data entry and observing all requirements are very important for expediting the customs clearance process.

5) Exports, import volumes, and Iran’s market status

Import and export volumes of mono-, di-, and trimethylamines to Iran The import volume of mono-, di-, and trimethylamines into Iran has been increasing in recent years due to high domestic industrial demand. These chemicals are mainly imported from China, India, and Germany.

Import volumes continue to grow steadily due to widespread use in chemical, pharmaceutical, and agricultural industries. As a developing country with significant chemical and petrochemical infrastructure, Iran has a high need for these materials.

In terms of exports, despite growth in domestic production, Iran is not currently a major exporter in global markets. However, due to increasing production capacity in petrochemical and chemical industries, there is high potential for exporting these materials to neighboring countries and the Middle East region especially Iraq, Turkey, and the United Arab Emirates.

6) Global circulation and main players

Exporting countries of mono-, di-, and trimethylamines worldwide China, Germany, the United States, and India are among the largest exporting countries of mono-, di-, and trimethylamines globally. With strong industrial infrastructure and advanced production technologies, these countries hold a large share of the global market.

Importing countries of mono-, di-, and trimethylamines worldwide Importing countries at the global level include Iran, Turkey, Saudi Arabia, the United Arab Emirates, and Western European countries. Due to strong chemical and pharmaceutical industries, these countries require substantial amounts of mono-, di-, and trimethylamines to produce their products.

7) Required documents for clearing mono-, di-, and trimethylamines

1. Proforma Invoice

The first required document for clearance is the proforma invoice. This document includes complete purchase information such as product name, unit price, quantity, and payment and delivery terms. The proforma enables the importer to provide initial purchase information to customs and begin the order registration process.

2. Commercial Invoice

The commercial invoice is issued after the purchase is confirmed and includes precise details of the goods, including quantity, price, and sales terms. This document is necessary for calculating customs duties and taxes and must be prepared completely and accurately.

3. Bill of Lading

The bill of lading indicates the transfer of goods from origin to destination by the carrier. It includes information such as the sender, consignee, quantity and type of goods, and place of delivery. The bill of lading is one of the essential documents for customs clearance.

4. Certificate of Origin

To determine customs tariffs and identify the country of production, providing a certificate of origin is essential. This document is issued by the exporting country’s chamber of commerce and helps customs determine duties and tariffs.

5. Material Safety Data Sheet (MSDS)

Due to the potential risks mono-, di-, and trimethylamines pose to health and the environment, providing an MSDS is mandatory. This document includes information such as chemical properties, safety notes for transport and storage, and procedures for dealing with incidents involving chemicals.

6. Necessary permits from relevant bodies

Importing mono-, di-, and trimethylamines requires obtaining permits from regulatory bodies. These include:

Permit from the Ministry of Health: to confirm product safety and health compliance.

Permit from the Department of Environment: to ensure no environmental harm.

Permit from the National Standards Organization of Iran: to verify product quality and compliance with national standards.

7. Order registration in the Comprehensive Trade System

Importers must register all information related to their goods in the Comprehensive Trade System. Designed to monitor trade processes and prevent violations, accurate information entry in this system facilitates the clearance process.

8. Customs Declaration

The customs declaration is a document the importer or customs broker must complete. It contains precise information on the goods and their value, and customs calculates the relevant tariffs and taxes based on this information.

9. Order registration permit

For importing mono-, di-, and trimethylamines, it is necessary to obtain an order registration permit from the Ministry of Industry, Mine and Trade. This permit confirms that the goods comply with Iran’s import regulations and can enter the country.

10. Transport Insurance Certificate

The transport insurance certificate is one of the essential documents for importing sensitive chemicals. This insurance covers potential losses during transportation and ensures compensation for possible damages.

11. Inspection Certificate

For certain sensitive consignments such as chemicals, an inspection certificate may be required. Issued by reputable inspection companies, it confirms that the goods comply with the specifications recorded in the invoice and other documents.

12. Operation license (if required)

If mono-, di-, and trimethylamines are imported for industrial or pharmaceutical production, an operation license from the relevant ministries may be required. This license confirms that the importer is authorized to use these materials for specific production purposes.

Need precise HS determination and permits from Health/Environment/Standards? Our team manages the entire case from A to Z.

Submit a proforma request

Frequently asked questions

What are the HS Codes for mono-/di-/trimethylamine?

Based on the text: MMA is declared under 292111, DMA under 292121, and TMA under 292122; the final line depends on technical specifications and end-use.

What permits are required for import?

Permits from the Ministry of Health, Department of Environment, and National Standards Organization; plus providing an MSDS and registering information in the Comprehensive Trade System.

Under which regulations are these materials transported?

Due to their hazardous nature, transport is carried out under international ADR regulations (and, as applicable, IMDG/IATA) with standard packaging and labeling.

Special clearance services for mono-, di-, and trimethylamines by Saba Brokerage

Saba Brokerage, one of the leading customs firms in Iran, provides specialized services for clearing mono-, di-, and trimethylamines, enabling importers to complete their clearance processes faster and more accurately. The services include:

- Specialized consulting and optimized solutions: Our expert team provides precise and practical guidance to help importers prepare and submit all required documents and permits completely and correctly.

- Expedited clearance: Leveraging experience and technical knowledge, we complete the clearance of mono-, di-, and trimethylamines in the shortest possible time and without customs issues.

- Continuous and precise follow-up: Every stage from order registration to final clearance is closely tracked to ensure all customs standards are met.

- Cost-effective solutions: We propose economical, optimized solutions to minimize importers’ costs and help them gain greater financial benefits.

- Safe transport: In cooperation with reputable carriers, full safety of chemical goods is ensured during all transport stages.

.png)