Customs Clearance of Extruding and Texturing Machines in Iran (HS Code + Documents and Permits)

To estimate the time and cost of clearing extruding and texturing machines, contact the experts at Saba Tarkhis.

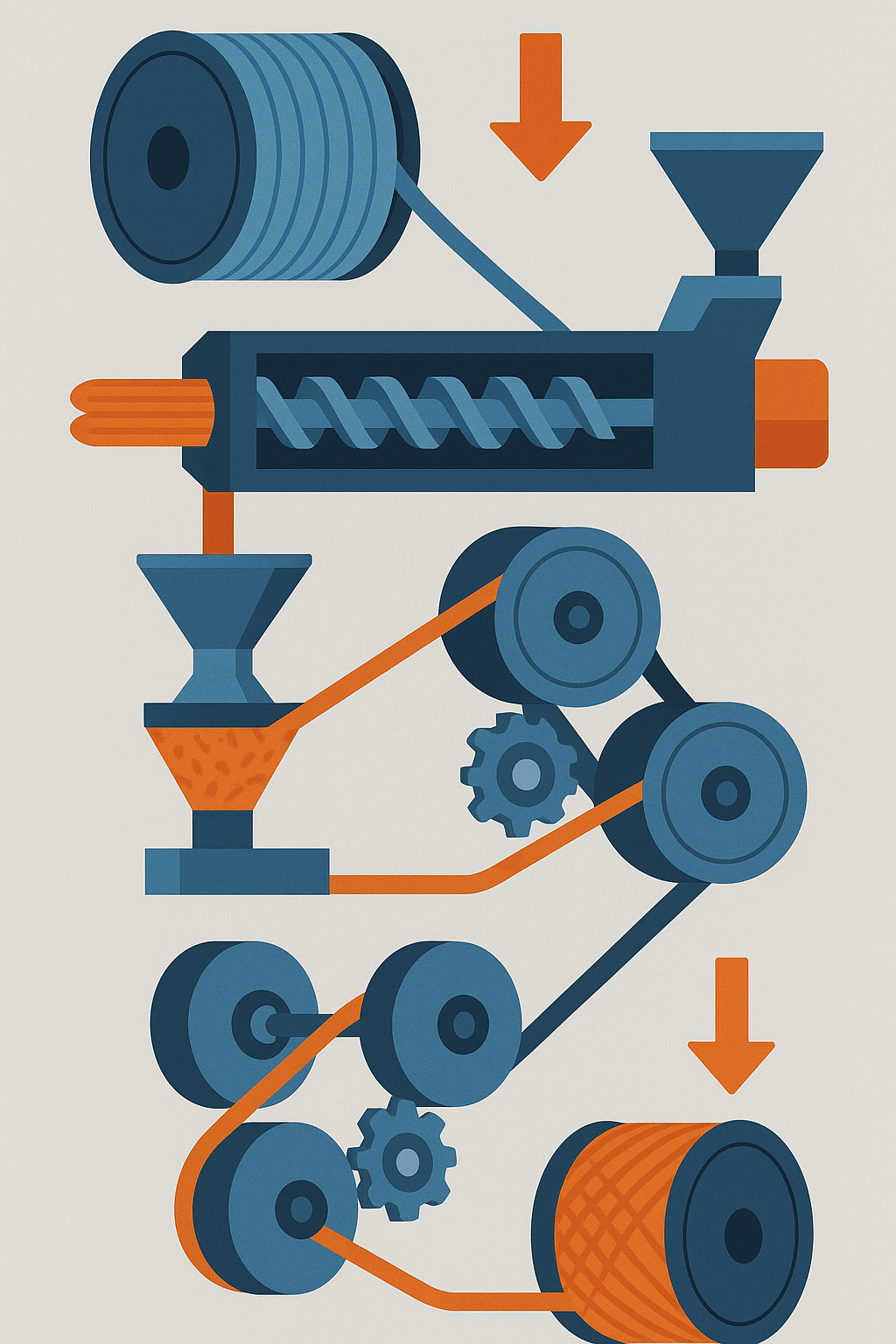

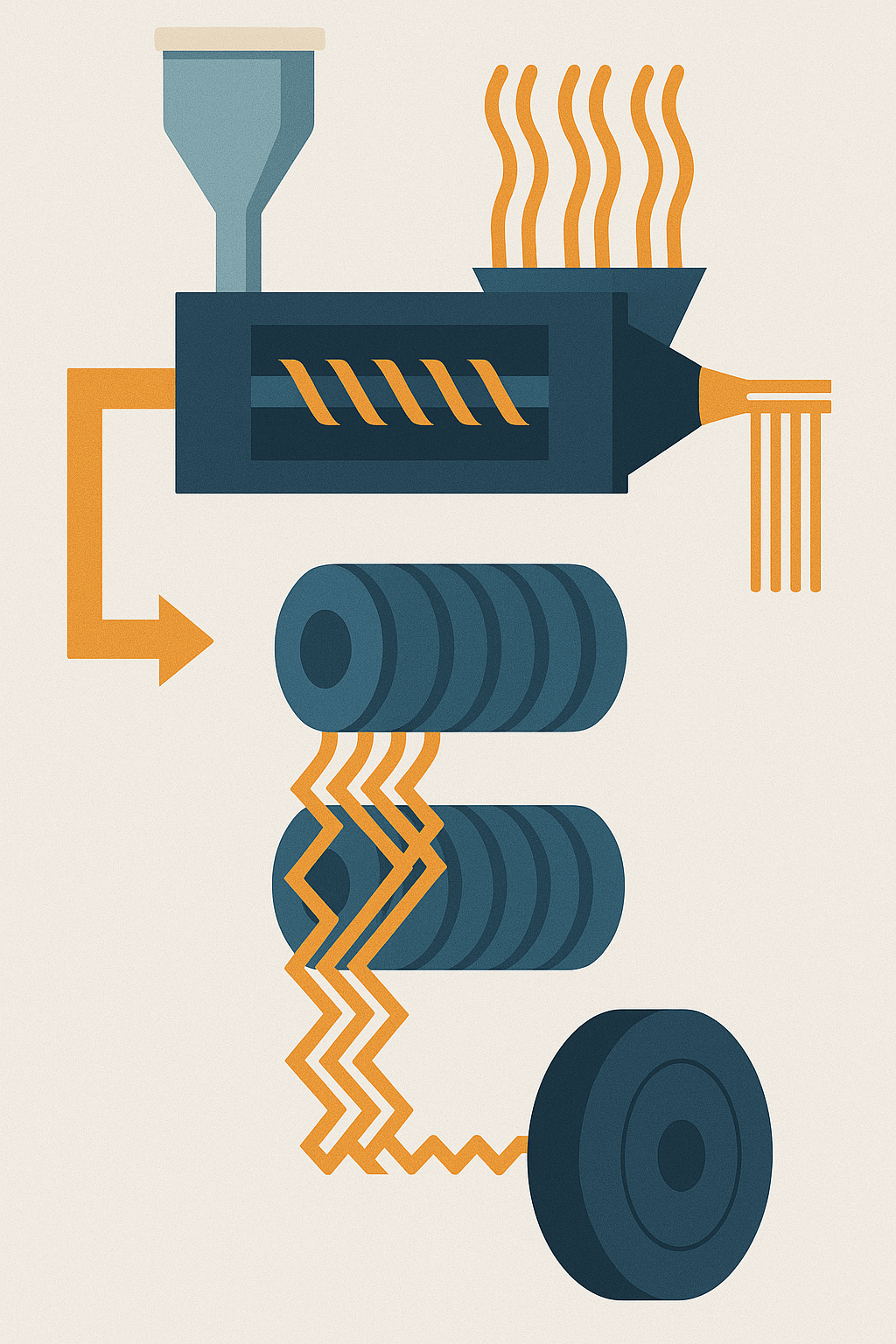

Immediate & Free Consultation1) Industrial Applications of Extruding and Texturing Machines

2) Technical Notes for Clearing Extruding and Texturing Machines

1. Customs Tariff and HS Code

2. Required Documents for Clearance

3. Customs Valuation

4. Import Conditions into Iran

3) Exporting/Importing Countries and Iran’s Market

4) Import/Export Statistics and Market Trends

5) HS Code and Customs Classification

| Item/Machine | Short Description | HS Code |

|---|---|---|

| Extruding/Texturing Machines | Plastic/Fiber processing; molding and texturing | 8477.10.00 |

Exact classification is determined based on application (plastic/fiber), capacity, accessories, and origin.

Need HS 8477.10.00 classification, standards/compliance, and document preparation? Our team manages the case end-to-end.

Submit Proforma Request

Frequently Asked Questions

What is the common HS Code for extruders/texturizers?

According to your text, these machines are typically classified under 8477.10.00; final classification depends on technical specifications and application.

Which documents are essential for clearance?

Commercial Invoice, Packing List, Bill of Lading, Certificate of Origin, and Inspection/Compliance Certificate; national/international standards as applicable.

Are there tariff incentives for this equipment?

Per the text, within production support policies, tariff discounts/tax exemptions may apply; case evaluation is required.

Special Customs Clearance Services by Saba Brokerage

Relying on extensive experience and expertise in clearing industrial machinery especially extruding and texturing our team provides comprehensive and efficient services to companies active across various industries. With the goal of optimizing import and clearance processes, this brokerage strives to support clients in achieving their business objectives and to complete clearance operations with maximum speed and minimal cost.

Services provided include:

Specialized consulting on customs tariffs: Saba Brokerage helps companies make the best decision in choosing the appropriate and optimized tariff code by precisely analyzing customs tariffs and having full knowledge of relevant HS Codes. This reduces customs costs and prevents potential issues.

Accurate goods valuation: Correct determination of customs value is one of the most important stages of clearance. Utilizing its knowledge and experience, this brokerage accurately determines customs values and prevents any disputes or potential penalties.

Preparation and drafting of required documents: Preparing and drafting the documents required for clearance including the Commercial Invoice, Packing List, Bill of Lading, and Certificate of Origin is another specialized service of this brokerage. The experienced Saba team prepares all documents carefully and according to customs requirements so that the clearance process proceeds without any defect or delay.

Follow-up and management of customs procedures: With full mastery of Iran’s customs laws and regulations and familiarity with international procedures, this brokerage continuously follows and manages all clearance stages from the moment goods enter customs until final delivery. This intelligent management accelerates clearance and minimizes additional costs.

Conducting inspections and standards: Our brokerage also coordinates the necessary technical inspections and obtains national and international standard certificates. These services help companies ensure full compliance of imported goods with the required standards.

Facilitating the obtaining of necessary permits: Obtaining various permits such as import permits, health permits, and other required authorizations is carried out swiftly and accurately by this brokerage. With complete familiarity with legal requirements, the Saba specialist team streamlines the permitting process.

Consulting on optimal transportation methods: Choosing the best transportation method plays an important role in reducing costs and delivery time. Saba Brokerage provides precise consulting in this field to help clients select the appropriate transportation method and avoid problems at this stage.

For more information, contact our experts.

.png)