Customs Clearance of Acyclic (Aliphatic) Hydrocarbons | Complete HS Guide + Documents

For estimating the time and cost of clearing acyclic (aliphatic) hydrocarbons, contact the Saba Tarkhis experts.

Free expert consultation1) Detailed Description of Acyclic Hydrocarbons and Clearance Features

- Clearly state the grade (Fuel-grade/Polymer-grade/Lab-grade) and percentage purity on the invoice and certificate of analysis.

- Declare country of origin, brand/supplier, containers (ISO Tank/Drum/IBC/Cylinder), and net/gross weights.

- Ensure labels comply with safety and dangerous-goods transport requirements where applicable.

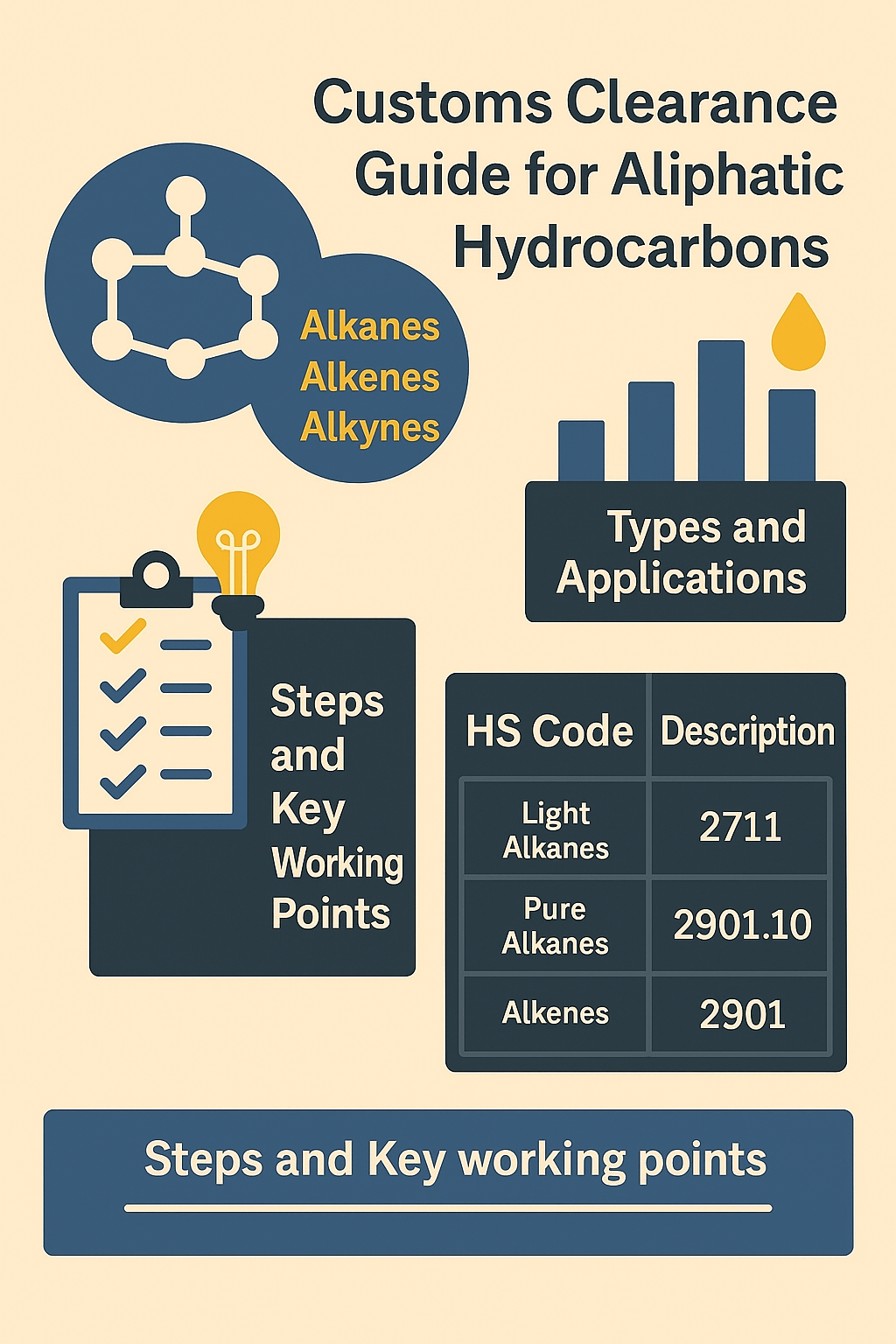

2) Types and Applications

Alkanes

Alkenes

Alkynes

3) Key Steps and Considerations in Clearing Aliphatics

Order Registration and Currency Allocation

Obtaining Permits and Standards Compliance

- Ministry of Petroleum / Ministry of Industry, Mine and Trade: import permits depending on substance type and application.

- Iran National Standards Organization: control of physical/chemical specifications and purity per national/international standards.

- Department of Environment and safety authorities: if classified as dangerous goods, comply with HSE and DG transport requirements.

4) Common Customs Tariffs / HS Codes

| Group/Example | Short Description | Indicative HS Code |

|---|---|---|

| Light alkanes: methane/ethane/propane/butane | Petroleum gases and gaseous hydrocarbons (LNG/LPG) | 2711 (per subheading) |

| Pure liquid alkanes (e.g., hexane/heptane) | Saturated, acyclic aliphatic hydrocarbon | 2901.10 (and finer splits) |

| Alkenes (ethylene/propylene/butenes) | Unsaturated, acyclic hydrocarbons | 2901 (specific subheadings) |

| Alkynes (acetylene …) | Acyclic hydrocarbons with triple bond(s) | 2901 (relevant subheading) |

5) Special Conditions for Import and Export of Aliphatics

- Need for specific permits from government bodies (as applicable: Ministry of Petroleum, MIMT, Standards Organization, Environment).

- Quality and purity control per national/international standards; non-conformity may cause holds/returns.

- Compliance with dangerous-goods rules (if applicable) and provision of related safety labels/documents.

6) Iran Market: Imports, Exports, and Destinations

7) Trade Volume and Duties/VAT Framework

8) Global Market: Key Players

9) Required Documents for Clearance

- Commercial invoice stating grade, purity, UN No (if applicable), and packaging

- Bill of lading with origin/destination, weights, and container type (ISO Tank/Drum/IBC/…)

- Certificate of Origin

- Import permits from relevant authorities (Ministry of Petroleum/MIMT/Standards/Environment)

- COA (Certificate of Analysis) and valid SDS (Safety Data Sheet)

- Packing list and insurance documents

- Proof of VAT payment and duties per declared HS line

Key Points and Practical Tips

- For light alkanes, review Chapter 27 (2711) alongside Chapter 29 (for special purities).

- Explicitly state purity and grade (Polymer-grade/Fuel-grade) in documents and labels.

- Follow SDS and HSE requirements for safe transport/storage.

- For sensitive shipments, plan sampling and testing in advance.

| Group | Dominant Application | Clearance Sensitivity | Control Note | Indicative HS |

|---|---|---|---|---|

| Light alkanes | Fuel/energy feed | High | UN No, transport pressure/temperature, safety | 2711 |

| Pure liquid alkanes | Solvent/process | Medium | Purity, boiling/flash points | 2901.10 |

| Alkenes | Polymer feed | High | Polymer-grade, impurities | 2901 (sub-splits) |

| Alkynes | Synthesis/cutting | High | Storage safety and pressure | 2901 (sub-splits) |

Need precise HS determination and a permits checklist? Our team manages the case end-to-end.

Submit proforma request

Frequently Asked Questions

For light alkanes (LPG/LNG), which HS chapter is more common?

For fuel-type gaseous/liquefied states, Chapter 27 (especially 2711) is commonly used; for purer laboratory derivatives, relevant subheadings of Chapter 29 (2901) are reviewed.

Which permits are essential to clear aliphatics?

Depending on the substance and application, permits from the Ministry of Petroleum/MIMT, the National Standards Organization, and—if environmental regulations apply—the Department of Environment are required.

What are the key technical documents for declaration?

COA (analysis), SDS (safety), container specs and physical state, grade and purity percentage, boiling/flash points, and UN Number where applicable.

How are taxes and duties calculated?

Based on CIF value and the periodic rates associated with the declared HS line; percentages may change with annual policies.

Specialized Customs Clearance Services by Saba Brokerage

As a reputable customs broker, Saba offers specialized services for chemical/petrochemical cases. These services focus on classification and HS consulting, order registration, obtaining required permits, and document management, carried out comprehensively to ensure a fast and trouble-free import process for this product group.

Specialized clearance services for aliphatics:

- Strategic and technical consulting: in-depth review of Chapters 27/29, HS determination, document preparation, and standards compliance.

- Executing order registration and permits: according to customs regulations and HSE requirements.

- Expedited clearance: coordination with relevant bodies, reducing dwell time and storage costs.

- Meticulous document management: preventing documentation gaps and facilitating assessment/sampling.

- Safe transport coordination: proper DG labeling and selecting suitable containers (ISO Tank/Drum/IBC).

.png)