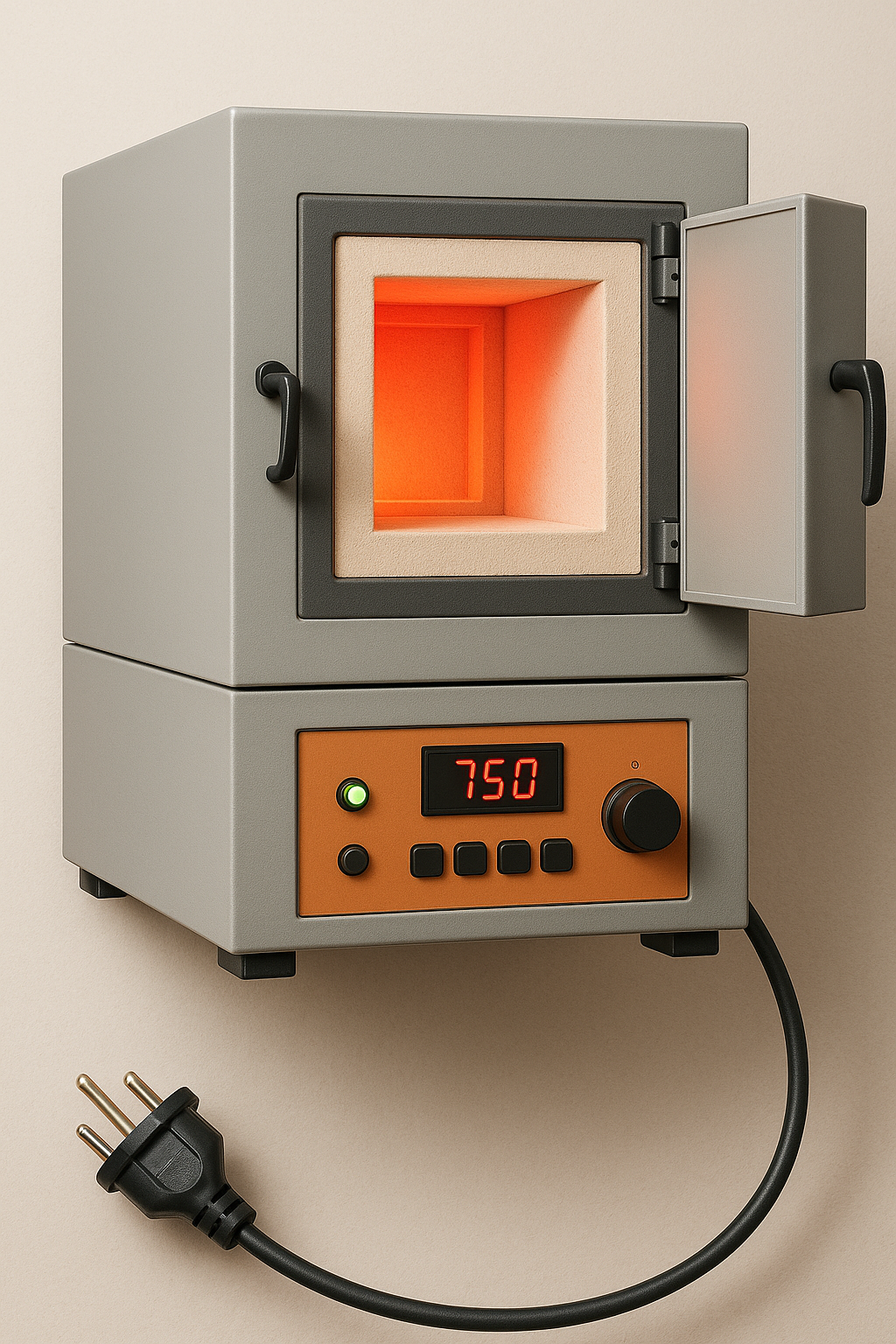

Clearance of Various Types of Industrial (Electric, Gas, Induction) and Laboratory Furnaces and Ovens from Iranian Customs (HS + Documents and Permits)

To estimate the time and cost of clearing industrial/laboratory furnaces and ovens, contact the experts at Saba Tarkhis.

Immediate and Free Consultation1) Types and Applications of Industrial or Laboratory Furnaces and Ovens

Types of industrial furnaces and ovens:

2) Key Points in Clearing Furnaces and Ovens from Customs

1. Identification and Determination of the Appropriate Customs Tariff (HS Code)

Industrial electric furnaces used in various industries for heat treatment operations are identified with HS Code 8514.30.90.

Gas or induction furnaces also have their specific HS Codes that must be carefully selected based on the type of fuel and the technology used.

Incorrect selection of the HS Code can lead to increased customs costs, delays in clearance, and even return of the goods to the country of origin. Therefore, an accurate and precise understanding of the device type and its application, and consultation with customs experts to choose the appropriate tariff code, is essential.

| Device Type | Short Description | HS Code |

|---|---|---|

| Industrial/Laboratory Electric Furnace | Heat treatment, baking/melting; resistive/element-based | 8514.30.90 |

| Gas Furnace (fossil fuel) | Thermal furnace with gas/diesel burner; industrial | 8514/8417* (depending on design/application) |

| Induction Furnace/Metal Melting | Induction heating; melting, casting, alloying | 8514* (specialized subheading) |

| Industrial Food Baking Oven | Baking bread/food at high capacity | 8514* (based on type and capacity) |

Determination of the exact subheading is based on capacity, fuel/heating type, application, control equipment, and device structure.

2. Compliance with National and International Standards

Electrical safety standards: These standards apply to electric furnaces and ensure they do not pose electrical hazards to users.

Environmental standards: These standards assess the environmental impacts of devices, such as pollutant emissions or energy consumption.

Technical standards: Technical standards include requirements related to device performance and quality that ensure goods are imported with an acceptable quality level.

Imported devices must have valid certificates from national or international organizations, and non-compliance with these standards may lead to rejection of goods at customs and their return to the country of origin..

3. Obtaining Specific Import Permits

Laboratory furnaces used in sensitive fields such as medical or chemical research require approvals from the Ministry of Health or the Atomic Energy Organization. These approvals ensure that the imported device complies with the specific standards and legal requirements of these fields. Large industrial furnaces used in production processes may require approvals from the Ministry of Industry or similar organizations. Failure to obtain these permits before importation can lead to seizure of goods at customs and additional costs.

4. Estimating Customs Costs and Taxes

Customs duties: This cost is determined based on the customs tariff (HS Code) and varies depending on the device type and country of origin.

Value Added Tax (VAT): Usually calculated based on the value of imported goods and must be paid at the time of clearance.

Brokerage/clearance costs: These costs include the costs related to the clearance process at customs as well as costs related to domestic transportation and warehousing.

Awareness of all these costs and proper financial planning can prevent financial issues in later stages and facilitate the import process.

5. Preparing and Submitting the Required Documentation

Commercial Invoice: Must contain complete details of the goods, including price, quantity, and technical descriptions.

Bill of Lading: The transport document indicating ownership of the goods and the mode of transport.

Certificate of Origin: This document confirms that the goods were produced in a specified country and is often used to determine the customs tariff.

Packing List: Includes detailed information on the number of packages, weight, and their dimensions.

Standards and safety certificates: These certificates include approvals related to compliance with national and international standards.

Submitting these documents accurately and completely speeds up the clearance process and prevents legal issues and delays in delivery of the goods.

3) Major Exporting and Importing Countries

4) Volume of Imports and Exports of Furnaces and Ovens to Iran

Need precise HS subheading determination, obtaining standards/permits, and preparing documents? Our team manages the furnace/oven clearance case end-to-end.

Submit Pro Forma Invoice Request

Frequently Asked Questions

What is the HS Code for industrial furnaces and ovens?

According to your text, industrial electric furnaces fall under 8514.30.90. Other types (gas/induction/industrial ovens) depending on construction, capacity, and application, are classified under the related subheadings in chapter 8514 or (in some constructions) 8417.

What permits are required for importing furnaces/ovens?

Depending on the device type: national standard/electrical safety approvals, for sensitive laboratory equipment approvals from the Ministry of Health/Atomic Energy Organization, and for large industrial units coordination with the Ministry of Industry (MIMT) or sectoral authorities.

Which documents are essential for clearance?

Invoice, bill of lading, certificate of origin, packing list, standards/safety certificates, and other technical supporting documents. Exact consistency of technical specifications across all documents is mandatory.

Special Customs Clearance Services by Saba Brokerage

Saba Brokerage, with years of experience in customs clearance and mastery of Iranian customs laws and regulations, offers comprehensive and professional services for clearing industrial or laboratory furnaces and ovens. These special services include the following:

Specialized consulting: Providing technical and legal guidance for accurate identification of customs tariff codes, obtaining required permits, and preparing necessary documentation to expedite the clearance process.

Fast and hassle-free clearance: Using a specialized team familiar with customs procedures makes it possible to clear your goods quickly and without concern.

Continuous follow-up: With continuous tracking of clearance stages from start to finish, it is ensured that goods are released from customs and delivered as quickly as possible.

Cost reduction: By leveraging the experience and knowledge of experts, solutions are provided to reduce customs and tax costs, helping you achieve significant savings.

Post-clearance support: Post-clearance services also include following up on financial matters and providing complete tax reports, helping clients confidently manage all their needs.

By relying on the experience and expertise of this team, you can carry out the clearance process of industrial or laboratory furnaces and ovens easily and confidently, receiving your goods on time and at an optimized cost.

.png)