Customs Clearance of Household Vacuum Cleaners in Iran (HS Code + Documents and Steps)

Household vacuum cleaner clearance from customs is one of the critical steps in the process of importing electronic goods and home appliances. This process not only requires mastery of customs laws and regulations, but also precise knowledge of tariff codes, standard requirements, and compliance with technical and legal matters in this field.

For an estimate of time and cost for household vacuum cleaner clearance, contact the experts at Saba Tarkhis.

Immediate and Free Consultation

1) Detailed Description and Importance of Clearance

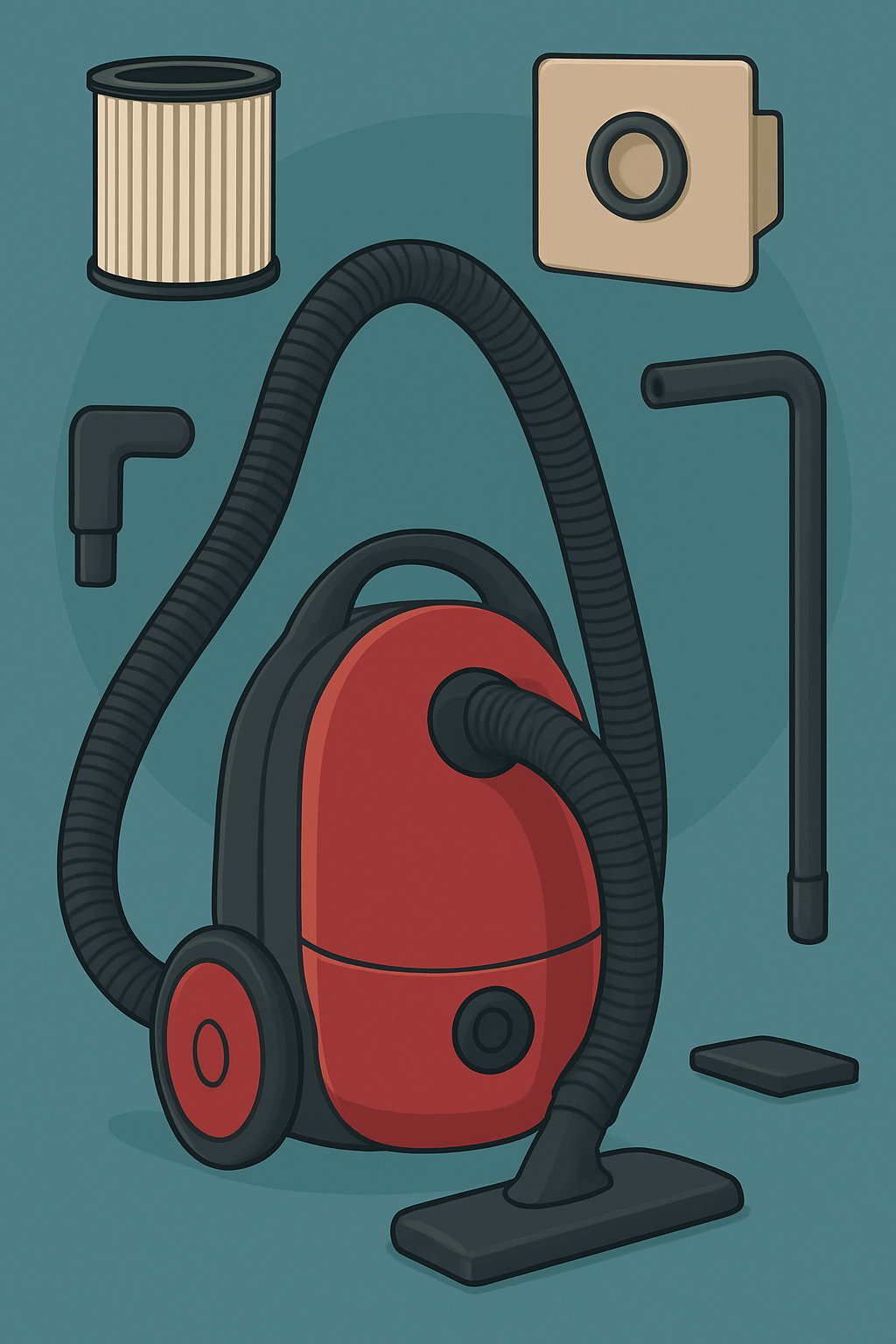

The household vacuum cleaner, as one of the most widely used electrical appliances in homes, plays a key role in maintaining hygiene and cleanliness of the living environment. Using powerful suction technology, it can collect dust, allergens, and other fine pollutants from various surfaces. Household vacuum cleaners are produced in various models such as bagged, bagless (cyclonic), robotic, and handheld. Each model, depending on its technology and design, has its own advantages and disadvantages that affect market choice.

2) Types and Applications of Household Vacuum Cleaners

Features and applications: Bagged, bagless (cyclonic), robotic, and handheld vacuum cleaners each have their own pros/considerations. Strong suction, HEPA filters, noise level, energy consumption, and accessories (nozzles/brushes) are key selection criteria. They are commonly used in homes, hotels, offices, and shops, playing an important role in environmental hygiene.

3) Customs Tariff and HS Code

| Product | Short Description | HS Code |

|---|---|---|

| Household Vacuum Cleaner | Electric, household use | 850810 |

Special models (e.g., robotic with advanced modules) may have subcategories/extra technical considerations; final determination depends on technical documents.

4) Specialized Clearance Steps and Key Points

- Household vacuum cleaner clearance from customs is a specialized process that requires full awareness of customs laws and precise compliance with standards related to this product. Below are the main stages of vacuum cleaner clearance from customs explained in detail:

1. Order Registration in the Comprehensive Trade System

Entering product data: The first step in clearance is registering the household vacuum cleaner order in Iran’s Comprehensive Trade System. At this stage, precise product data including type, model, HS Code, country of origin, number of imported units, and technical specifications are entered.

Initial approvals: After submitting the data, initial approvals are issued by the Ministry of Industry, Mining and Trade.

2. Obtaining Necessary Permits

National and safety standards: Household vacuum cleaners must comply with national and international standards. For clearance, obtaining certificates of standard and safety from the Institute of Standards and Industrial Research of Iran is required. This includes approvals such as energy consumption and electrical safety.

Special permits: In some cases, environmental or health permits may also be required for clearance.

3. Transportation and Entry to Customs

International transport: After obtaining permits, household vacuum cleaners are shipped from the country of origin to Iran. This process may be carried out via sea, air, or land transport.

Entry to customs: Upon arrival at Iranian borders, vacuum cleaners are transferred to customs warehouses and prepared for clearance steps.

4. Declaration Submission and Document Presentation

Customs declaration: The importer or legal representative (such as a customs broker) must complete the customs declaration and submit it to customs. This declaration includes full details of the goods, their value, shipping and insurance costs.

Document submission: Documents such as the bill of lading, commercial invoice, packing list, certificate of origin, and obtained permits must be submitted to customs.

5. Inspection and Valuation of Goods

Technical inspection: Customs may conduct inspections to ensure the goods match the declared data. At this stage, vacuum cleaners are checked for technical specifications, energy consumption, energy labeling, and compliance with safety standards.

Valuation: Customs experts determine the value of the goods to calculate customs duties and tariffs.

6. Payment of Customs Duties and Charges

Calculation and settlement: After valuation, customs calculates the costs related to customs duties, value-added tax, customs service fees, and special charges. The importer must pay these in full to clear the goods.

7. Issuance of Clearance License

Clearance license: After payment of all charges, customs issues the clearance license which permits the release of goods from the warehouse and delivery to the final destination.

8. Delivery of Goods and Final Clearance

Domestic transport: After receiving the clearance license, vacuum cleaners are transported from the customs warehouse to the final destination (such as the importer’s warehouse or retail shops).

Delivery: The goods are delivered to the final destination and the clearance process ends.

9. Post-Clearance Follow-up

Financial records: The importer must record the clearance and related costs in their financial systems.

Handling issues: In case of any problem or need for follow-up, the importer can contact customs or their broker.

5) Special Import and Export Conditions

- Importing household vacuum cleaners into Iran is subject to a set of legal requirements and regulations. These include compliance with national standards, obtaining necessary permits, and consideration of special import conditions from certain countries. Exchange rates and trade policy changes also affect imports of this product. In terms of exports, due to high-quality domestic production, Iran can target potential markets in neighboring countries as well as African and Asian markets. Improving production quality and compliance with international standards can significantly increase Iran’s share in global markets.

6) Major Exporting and Importing Countries

Exporting countries: Household vacuum cleaner exports are mainly carried out by leading producers of electronic equipment and home appliances. The largest global exporters include China, Germany, the United States, South Korea, and Japan. These countries, relying on advanced technology and high production capacity, supply a large share of the global market demand. China in particular is recognized as the world’s largest exporter of vacuum cleaners, with many reputable global brands manufacturing in this country.

Importing countries: On the other hand, the largest importers of household vacuum cleaners include the United States, Western European countries such as Germany and France, Japan, and South Korea. Due to high consumer demand, these countries import significant quantities of such products. In Iran as well, imported vacuum cleaners play a major role in meeting domestic market needs, with a significant share supplied through imports.

7) Key Compliance, Energy Labeling, and Packaging Notes

- Consistency of model name, power (W), voltage/frequency, and serial number across device, carton, and invoice.

- Providing a user manual/safety warning label in an acceptable language.

- Packaging protection against impact/moisture and inclusion of handling symbols.

Need precise HS determination, obtaining standard permits, and managing costs? Our team handles the vacuum cleaner case from A to Z.

Submit Proforma Request

Frequently Asked Questions

What is the HS Code for household vacuum cleaners?

Generally declared under 850810 (household electrical vacuum cleaners). Special models may require additional technical documentation.

What permits are required for clearance?

National standard certificate, electrical safety, and energy labeling; if requested, test results and certificate of conformity.

What is the import tariff rate for vacuum cleaners?

It varies depending on origin and specifications; final determination after valuation and application of duties and charges at customs.

Special Clearance Services by Saba Brokerage

Saba, as one of the leading and most reputable customs service providers in Iran, focusing on household vacuum cleaner clearance and other goods, offers a wide range of specialized services. Our professional team, with extensive knowledge and experience in customs laws and international standards, manages the clearance process comprehensively from start to finish. Our goal is for clients to deliver their goods to the final destination in the shortest possible time and at optimal costs, with complete confidence and without concern.

Some of our special and expert services include:

Specialized consultation: By thoroughly analyzing the conditions and needs of importers, we suggest the best clearance methods. This consultation is based on deep analysis of customs laws and market conditions to ensure maximum efficiency and minimum costs.

Order registration and follow-up: All administrative and legal steps related to importation, from order registration in the Comprehensive Trade System to necessary follow-ups during the clearance process, are handled carefully by our team. This includes managing all required documents and coordination with relevant authorities.

Obtaining necessary permits: We obtain all essential permits from relevant authorities quickly and accurately. These permits include standard approvals, safety and environmental permits, and other specific authorizations depending on product type.

Inspection and technical evaluation of goods: To ensure full compliance of goods with national and international standards, our team performs inspections and technical evaluations. These include checking technical specifications, compliance with energy and quality standards, and verifying the accuracy of provided documents.

Managing customs costs: With our experience in managing customs duties and charges, we help reduce costs and speed up the clearance process. This includes accurate calculation of costs and providing optimal strategies for managing them.

Leveraging strong relations with government bodies and full awareness of changes in customs regulations, Saba can complete the clearance process in the shortest possible time and at the lowest cost. We also provide clients with continuous follow-up and accurate updates to ensure imported or exported goods reach their final destination without any issues.

For more information and expert consultation, contact us now.

.png)