Customs Clearance of Nail Extension Tools in Iran (HS Codes, Documents, Steps & Permits)

For estimating the time and cost of nail extension tools clearance, contact the experts at Saba Tarkhis.

Instant Free Consultation

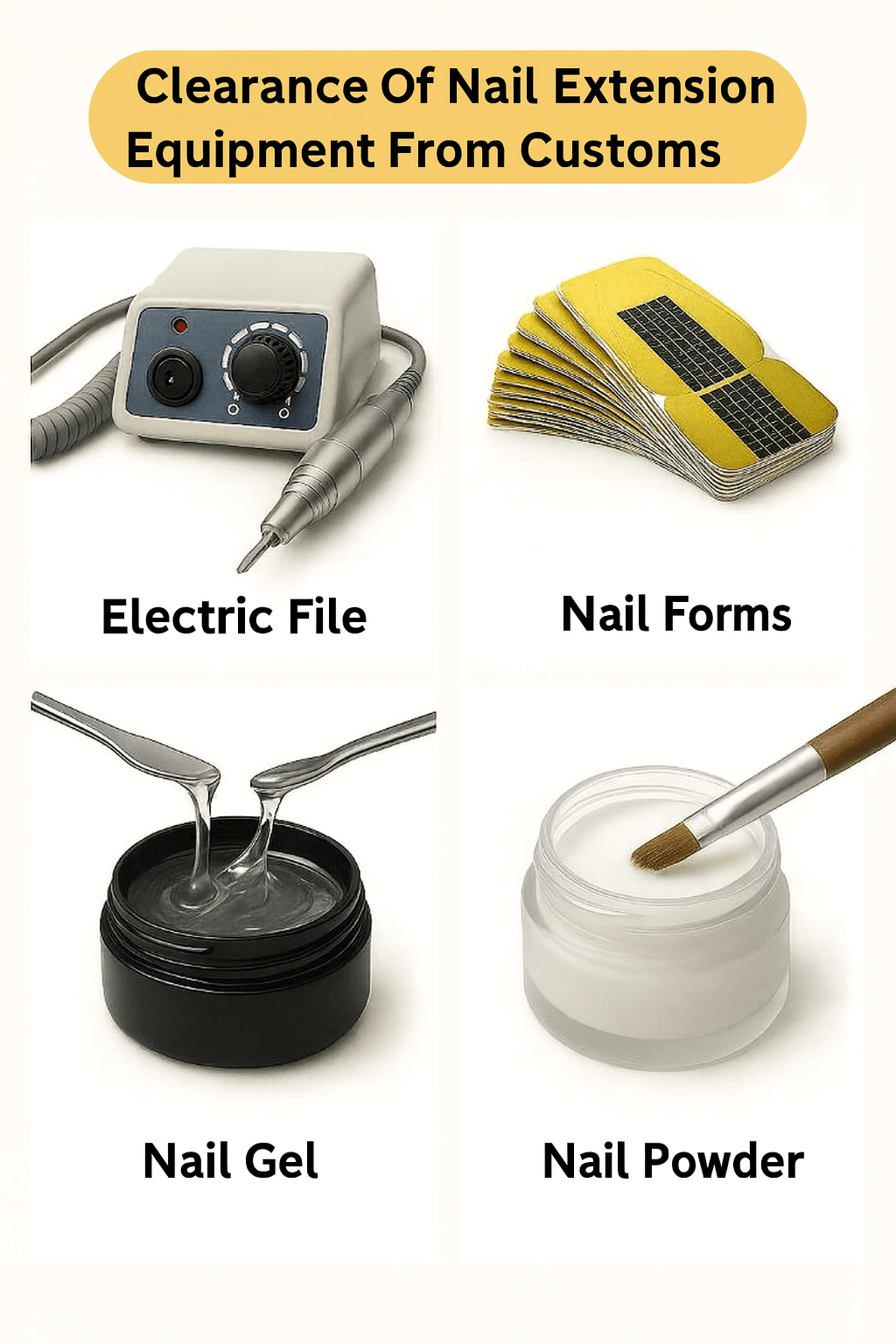

1) Nail Extension Tools

| Item/Goods | Short Description | HS Code | Approx. Duty |

|---|---|---|---|

| Acrylic Powder/Monomer | Basic chemical materials for extensions | 390690 / 320820 | ≈ 10–20% |

| Extension Gels (UV/LED) | Widely used gel materials | 350610 / 320820 | ≈ 10–25% |

| Extension Brushes | Precision tools for working with materials | 960330 | ≈ 5–10% |

| Nail Forms (Plastic/Metal) | Shaping artificial nails | 392690 / 732690 | ≈ 15–20% |

| Primer & Top Coat | Cosmetic/hygiene products | 330430 | ≈ 10–25% |

| UV/LED Lamps | Gel dryer; electric | 853939 | ≈ 15–25% |

| Electric Nail Drill | Electric shaping/polishing | 846729 | ≈ 10–20% |

| Nail Tips | Base for artificial nails | 392690 | ≈ 15–20% |

| Nail Glue | Attaching tips to nails | 350610 | ≈ 10–15% |

| Cutter & Nipper | Manicure/pedicure tools | 821420 | ≈ 5–10% |

| Manual File | Smoothing/shaping | 821490 | ≈ 5–15% |

| Cleanser Pads | Cleaner/gel wipe | 340119 | ≈ 10–20% |

The above duty figures are cited based on your text and may vary depending on origin/type/packaging and current regulations; final determination rests with customs/competent authorities.

2) Exporter and Importer Countries of Nail Extension Tools

3) Steps for Customs Clearance of Nail Extension Tools

1. Order Registration in the MIMT System

Before goods enter the country, importers must register their order in the Ministry of Industry, Mine and Trade’s Comprehensive Trade System. This stage is very crucial, and the main documents including the purchase invoice, bill of lading, and certificate of origin must be submitted to the system. Without order registration, customs clearance will not be possible.

Documents required for order registration:

Purchase Invoice: includes precise product information, quantity, and price.

Bill of Lading: title document and shipping information.

Certificate of Origin: confirmation of the producing country, issued by the Chamber of Commerce of the country of origin.

2. Submitting Documents to Customs

After the goods arrive at customs, the importer must submit the required documents to the customs office for the clearance process to begin. Required documents include the final purchase invoice, bill of lading, certificate of origin, health permits, and standards. In case of importing chemicals such as gels and nail extension powders, submitting a chemical analysis sheet is also mandatory.

3. Quality and Standards Inspection

Supervisory organizations, including ISIRI and the Ministry of Health, inspect the quality and safety of nail extension tools and materials. For electrical devices such as UV lamps and electric drills, electrical safety approvals are required. Also, chemical materials such as gels and powders must be approved for hygiene and health compliance.

4. Payment of Customs Duties and Fees

After complete review of documents and receiving the necessary approvals, the importer must pay customs duties and related fees. These duties vary depending on the type of goods and the HS Code and may include customs duty, VAT, warehousing fees, and customs service charges.

4) Challenges of Clearing Nail Extension Tools

Compliance with health standards: Chemical materials such as gels and acrylic powders must comply with the health standards of the importing country. This can be time-consuming and requires careful review of documents and health approvals.

Safety approvals for electrical equipment: UV and LED devices, as electrical equipment, require safety approvals and international electronic standards.

Variable duties and customs costs: Customs duties may vary depending on the product type and country of origin. These changes can affect the final import costs.

5) Required Documents for Clearing Nail Extension Tools from Customs

1. Purchase Invoice (Invoice)

The purchase invoice is one of the main documents providing complete information about the goods, including price, quantity, type of goods, and seller/buyer details. This invoice is an important financial document used in all import and clearance stages.

2. Proforma Invoice

The proforma invoice is an initial and proposed document that provides complete information about the goods and transaction terms before final purchase confirmation. This document is also required for order registration in the Comprehensive Trade System.

3. Bill of Lading

The bill of lading is a document that includes information related to the transport of goods. It specifies details such as the mode of transport (sea, land, or air), origin and destination, and shipping conditions. This document is submitted to customs so that the goods can be released after review.

4. Certificate of Origin

The certificate of origin is issued by the Chamber of Commerce of the producing country and shows where the goods were manufactured. This certificate is very effective in determining customs duties and trade facilities.

5. Health Permit and Iranian FDA Approvals

If nail extension tools include chemical materials such as gels and acrylic powders, health permits must be obtained from the Ministry of Health and the Food and Drug Administration. These permits ensure the goods are safe for market use.

6. Chemical Analysis Report

For importing chemicals, such as nail extension powders, submitting an analysis sheet containing the chemical composition of the goods is mandatory. This sheet is presented to customs to ensure product quality and safety.

7. Standard Certificate

If nail extension tools include electrical devices such as UV and LED lamps, the goods must comply with Iranian national standards. This certificate confirms that the goods conform to safety and quality standards.

8. Order Registration in the Comprehensive Trade System

Importers must register their order in the Comprehensive Trade System for the necessary import permits to be issued. This is one of the main stages of import, and without it, the goods will not be allowed to enter the country.

9. Commercial Card

Importers need a commercial card to conduct trade and import goods. This card, issued by the Iran Chamber of Commerce, grants the legal permission to import to its holder.

10. Inspection Certificate

In some cases, to ensure quality and compliance with standards, an inspection certificate from reputable inspection companies is required. This certificate guarantees that the goods conform to the specifications provided in the documents.

11. Cargo Insurance Policy

The cargo insurance policy indicates that the goods are insured during transportation. If the goods are damaged during transport, this insurance covers the losses.

12. Customs Declaration

The customs declaration is a document submitted by the importer to customs and includes detailed information about the goods, quantity, value, and shipping details. This document is essential for assessment and determining the amount of customs duties.

13. Tax Approval (Value-Added Tax - VAT)

To clear goods from customs, VAT must be paid. Usually this tax is 9% of the value of the goods, which the importer is obliged to pay for the final clearance permit to be issued.

Need precise HS Code classification, health/standards permits, and document preparation? Our team manages the case end-to-end.

Submit Proforma RequestFrequently Asked Questions

How are HS Codes for nail extension items determined?

Based on the type of goods, material, use, and packaging; for example, gels are examined under 350610/320820 and devices under 853939; final determination is by customs.

What permits are required for chemicals (gel/powder)?

As applicable: health permits and approval by the Iran Food and Drug Administration, submission of a Chemical Analysis Report, and compliance with import standards for cosmetic/hygiene products.

What approvals are needed for UV/LED devices?

Compliance with electrical safety standards and possibly evaluations by the Institute of Standards and Industrial Research of Iran (ISIRI); manufacturer technical documents and test reports are essential.

How is VAT calculated for clearing these items?

Typically, 9% VAT is calculated and collected on the customs value + import duties.

Special Customs Clearance Services by Saba Brokerage

With extensive experience in customs clearance, one of the top customs brokers in Iran provides specialized services in clearing nail extension tools. Utilizing a professional team familiar with customs and trade laws, this firm is capable of comprehensively managing processes related to importing goods. The services provided include the following:

Specialized Legal and Customs Consulting: Providing specialized advice on customs duties, required permits, and international standards, accompanying importers through all clearance stages and informing them of any legal complexities.

Order Registration and Follow-up of Customs Procedures: The firm’s expert team, fully proficient in the order registration process in the MIMT system, swiftly and accurately completes all administrative and customs affairs and prevents unnecessary delays.

Expediting Customs Clearance: One of the greatest advantages of cooperation is the high speed of clearing goods from customs. Using its broad network and relationships in the customs system, the company delivers imported goods to customers in the fastest possible time.

Post-Clearance Services: After clearance, the firm provides services such as transportation and warehousing to ensure that imported goods reach their final destination safely and as quickly as possible.

Ultimately, cooperation with this company specialized in customs clearance assures importers that the process of importing nail extension tools is carried out more smoothly, enabling them to continue operating in a competitive market without concern.

.png)