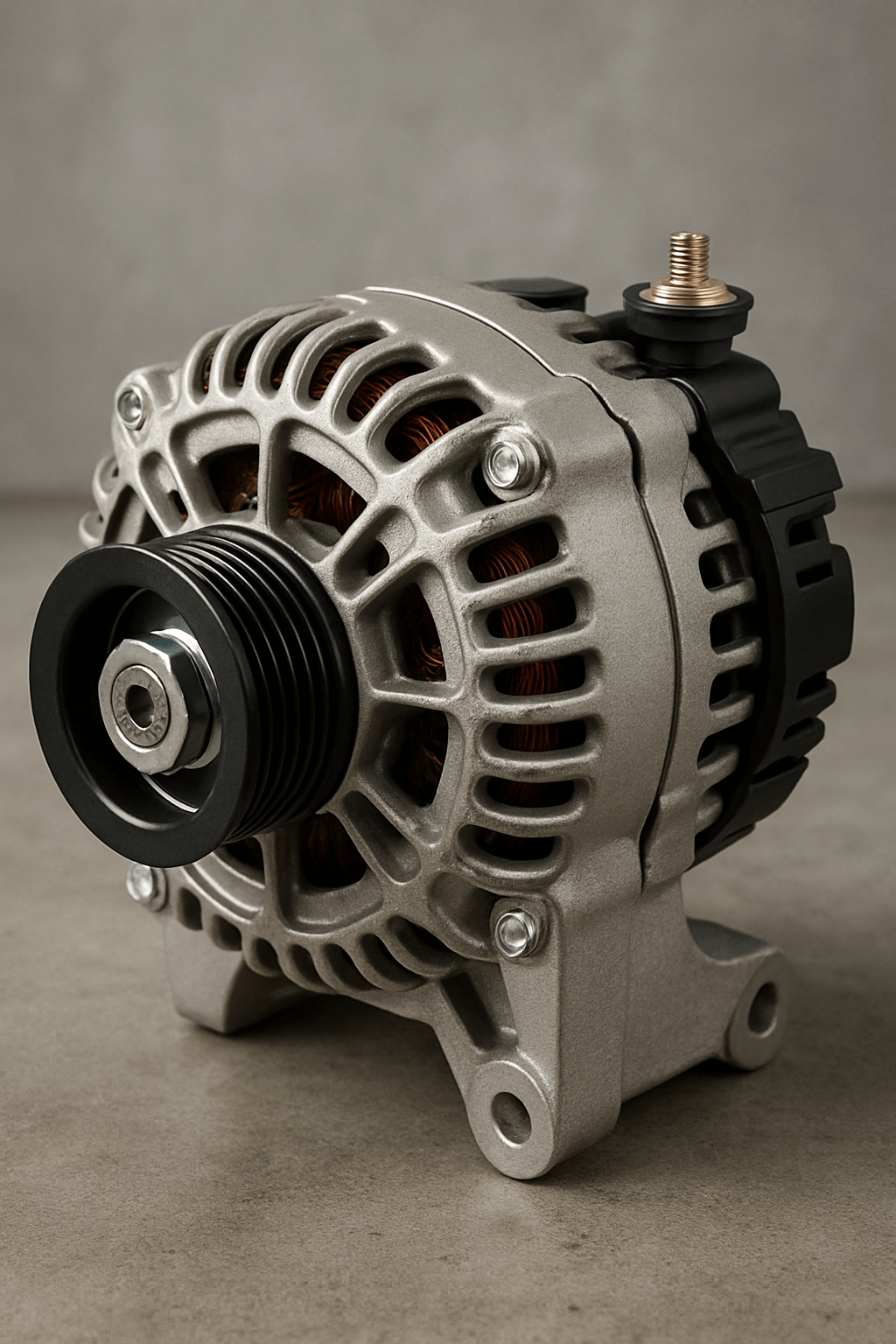

Car Alternator Customs Clearance in Iran (HS Code + Documents & Permits)

For estimating the time and cost of car alternator customs clearance, contact the experts at Saba Tarkhis.

Instant Free Consultation1) Important Notes for Importing and Clearing Car Alternators

2) Required Documents and Papers for Car Alternator Clearance

Commercial Invoice

Packing List

Certificate of Origin

Import Permit

Certificate of Compliance (Standards)

Health and Safety Certificate

Customs Declaration

Transport Insurance Policy

Pre-shipment Inspection Certificate

3) Conditions for Importing Car Alternators

Technical and Quality Tests

Import Regulations and Restrictions

4) Producing/Exporting Countries and Iran’s Import Status

Status of Alternator Imports into Iran

5) Best Practices for Clearance

Use customs consultants: Leveraging the services of professional customs consultants and brokers can accelerate clearance and reduce the likelihood of error.

Complete document preparation: Preparing complete and accurate documents for submission to customs can facilitate clearance and prevent delays.

| Goods | Short Description | HS Code |

|---|---|---|

| Car alternator ≤ 750 W | Vehicle power generator; 12/24V | 8501.20.00 |

| Car alternator > 750 W | Higher-power generator | 8501.40.00 |

The import duty rate—depending on trade agreements and the country of origin—is usually in the 5–15% range; the final determination is made based on the declaration and technical documents.

Need precise HS Code determination, obtaining permits, and document preparation? Our team manages the case end-to-end.

Submit a Proforma Request

Frequently Asked Questions

What is the HS Code for car alternators?

As noted, alternators are usually declared under 8501.20.00 (≤750 W) and 8501.40.00 (>750 W); final determination depends on technical specifications and manufacturer documentation.

What is the duty rate for car alternators?

According to the text, the import duty is generally in the 5 to 15 percent range and may be reduced by trade agreements; it is recommended to check the latest rates at the time of declaration.

What documents are required for alternator clearance?

Commercial invoice, packing list, certificate of origin, import permit, standards certificate (ISO/CE/UL), customs declaration, insurance policy, and pre-shipment inspection certificate if required.

Special Customs Clearance Services by Saba Brokerage

With years of experience and expertise in customs clearance, Saba Brokerage is recognized as a leader in providing comprehensive and professional services to facilitate the clearance process for car alternators and other goods. Our special services are designed to cover all aspects of customs clearance and to carry out procedures in the simplest and fastest possible way. Our special services include the following:

1. Specialized Consulting

Our team of experts, with a deep understanding of customs laws and regulations, provides you with specialized consulting in various customs clearance areas. These services include:

Determining customs tariffs: Precisely identifying tariffs for different goods, including car alternators, to determine import costs and forecast ancillary expenses.

Identifying HS codes: Assisting in accurately identifying and selecting HS codes for correct classification of goods and preventing errors in customs declarations.

Understanding legal requirements: Providing comprehensive information on the legal requirements and permits needed for imports and exports to ensure full compliance and avoid possible delays.

2. Document and Records Management

Our team carefully and efficiently prepares and manages all documents and records required for clearing car alternators. These services include:

Preparing invoices and bills of lading: Reviewing and preparing purchase invoices and bills of lading completely and accurately.

Completing customs declarations: Drafting and completing customs declarations correctly and in accordance with regulations.

Liaison with customs offices: Carrying out necessary coordination with various customs offices to facilitate the clearance process and ensure prompt acceptance of documents.

3. Expediting the Clearance Process

By leveraging extensive networks and practical experience, we can significantly accelerate the customs clearance process. Our services include:

Reducing waiting time: Handling administrative steps and customs formalities quickly and effectively.

Strategic management: Employing effective strategies to reduce processing time and prevent delays.

4. Resolving Customs Issues

When facing customs issues or disputes, our team acts quickly and effectively to resolve matters. These services include:

Dispute management: Reviewing and analyzing customs issues and providing appropriate solutions.

Support for appeals handling: Providing full support in case of appeals or requests for amendments.

5. Post-Clearance Support

After completing the clearance process, our team continues to support clients to ensure they benefit from after-sales services and final setup needs. These services include:

Assistance with receiving goods: Making the necessary arrangements for delivery and receipt of cleared goods.

Post-clearance consulting: Providing advice on usage and maintenance of goods and any additional needs after clearance.

Proudly serving as a trusted partner in the customs clearance process, Saba Brokerage is committed to delivering the best services with the highest quality and precision. By trusting our team, you can enjoy a hassle-free and professional experience in customs clearance. For free consultation and more information, contact us and let us help you in the simplest and most effective way possible.

.png)