Customs Clearance of Tea Makers in Iran (HS Code + Documents and Standards)

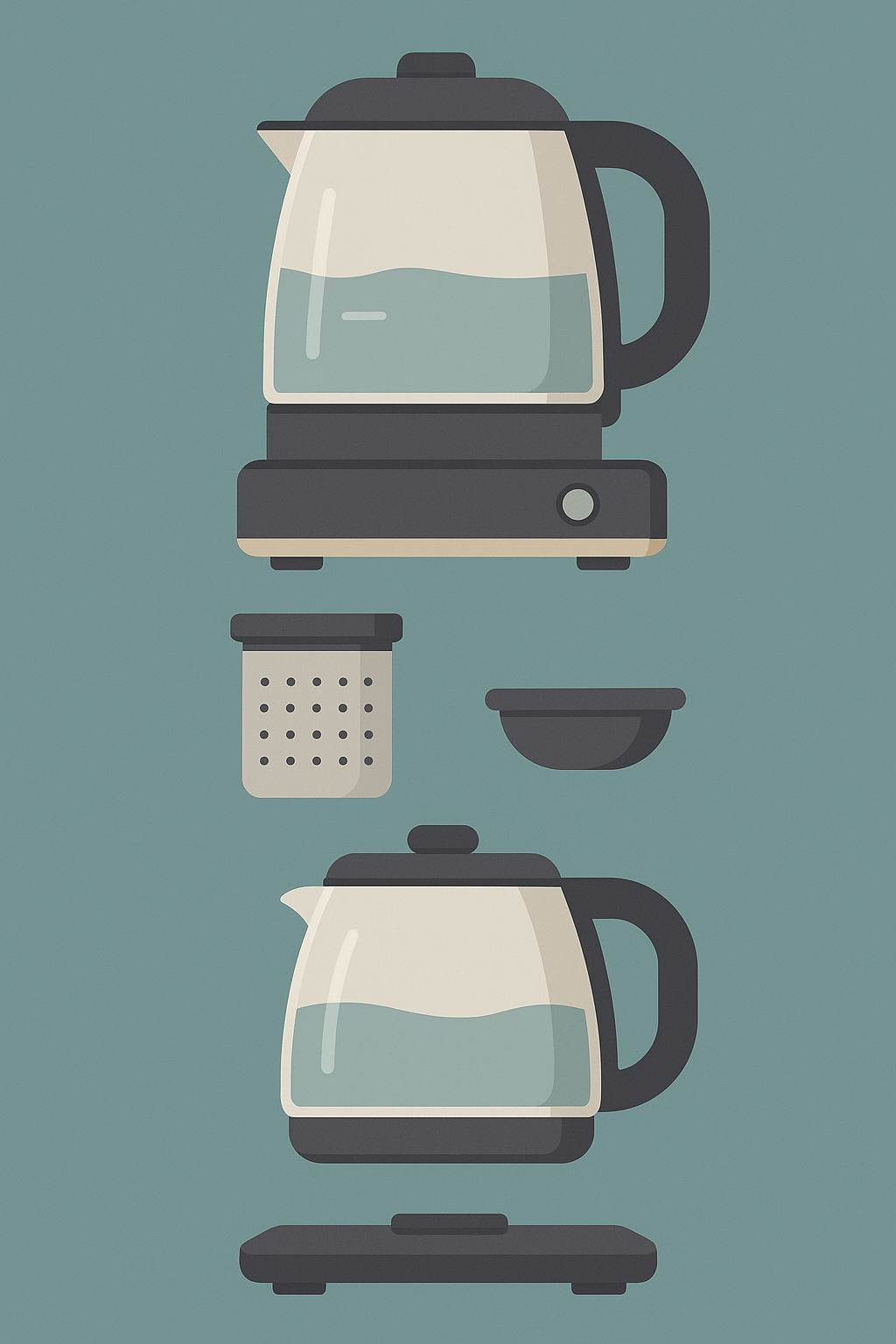

Electric Kettle: This part boils the water and typically uses electric heating elements to bring water to the boiling point quickly. Many models feature temperature control, allowing you to set precise temperatures for different types of tea and herbal infusions.

Teapot: The second part of the tea maker is the teapot, used for brewing tea. Some models come with glass or stainless-steel teapots whose design not only looks elegant but also optimizes the brewing process.

To check the time and cost for clearing tea makers, contact the experts at Saba Tarkhis.

Immediate Free Consultation

More advanced tea maker models may include additional features such as:

Coffee and infusion preparation capability: Some devices are equipped with options for preparing coffee and herbal infusions.

Steamer function: This feature is particularly useful in professional models for cooking and steaming various foods.

Memory and timer: Advanced devices have timers and memory to automatically set temperature and brewing time.

Applications of tea makers – Household use:

Household use:

Fast and easy tea preparation: These devices are very useful at home for preparing tea and infusions quickly and simply, offering a convenient hot-beverage experience.

Temperature control: The ability to set precise temperatures for different teas (such as green tea, black tea, and herbal infusions) is an important feature of these devices.

Commercial environments:

Offices and workplaces: Tea makers are used in offices and workplaces to serve beverages to staff and guests, helping enhance the hospitality experience.

Hotels and restaurants: In hotels and restaurants, these devices are used to serve hot beverages to guests and can improve service quality.

Professional models:

Cafés and catering centers: Tea makers with more advanced features are used in cafés and catering venues to prepare various drinks and provide fast, efficient service.

Key points in the tea maker clearance process – Knowing the customs tariff code:

Knowing the customs tariff code:

Tea makers fall under customs tariff code 8516.60.00.00 . This specific code covers heating devices and appliances for preparing tea and coffee. It must be used carefully when calculating customs tariffs and import duties. It includes devices specifically designed for preparing and heating hot beverages.

Classification and tariff codes for tea makers

Tea makers are professionally categorized into various groups which, depending on their technical features and functionality, fall under different customs tariff codes. Below are the types of tea makers along with their related tariff codes and technical notes:

1. Electric Tea Makers

Tariff code: 8516.60.00.00

Description: These devices primarily include an electric kettle for boiling water and a teapot for brewing tea. Electric tea makers are classified under this tariff code because they are designed for rapid and efficient water heating and hot beverage preparation. They are typically equipped with automatic electric heating elements.

2. Multifunction Tea Makers

Tariff code: 8516.79.00.00

Description: In addition to boiling water and brewing tea, this category provides extra capabilities such as preparing coffee, herbal infusions, and steaming. Multifunction models may offer advanced settings for temperature and timers, enabling precise control of the beverage-making process.

3. Professional Tea Makers

Tariff code: 8516.79.00.00

Description: Professional tea makers are designed for commercial and industrial use and can prepare high volumes of tea in a short time. These devices often feature advanced technologies such as precise temperature and pressure control and are used in cafés and catering centers.

4. Digital Tea Makers

Tariff code: 8516.60.00.00

Description: Digital tea makers come with advanced technologies such as touchscreens and digital settings. Thanks to their digital features and precise controls, they fall under the same tariff code as electric tea makers.

5. Portable Tea Makers

Tariff code: 8516.79.00.00

Description: These devices are designed for travel and small spaces. Due to their portable and lightweight design, they can be used easily in various conditions. They may have simpler functions compared to other models.

6. Specialty Tea Makers

Tariff code: 8516.79.00.00

Description: Specialty tea makers offer unique features such as precise temperature settings for different teas, advanced filters, and diverse functions. Owing to their specialized features, they are generally included under the same tariff code as professional and multifunction devices.

Required documents and paperwork – Commercial invoice:

Commercial invoice: Includes seller name, exact device specifications, purchase price, and payment terms. It must contain all item details to enable thorough customs review.

Proforma Invoice: Used to confirm the device’s price and features and represents the preliminary purchase invoice. It must include precise, comprehensive information about the device.

Certificate of Origin: Confirms the country of origin and authenticity of the goods, proving that the item was exported from a specific country. It is usually issued by the exporter country’s chamber of commerce.

Certificate of Compliance: Required to confirm the device’s conformity with Iran’s safety and quality standards. It should demonstrate compliance with national and international standards.

Customs paperwork: Includes the customs declaration and receipts for duties and taxes, which are essential for registering and confirming the clearance process at customs.

Standards and requirements:

Tea makers must comply with safety and quality standards set by standard organizations in the country of origin and in Iran. These standards include electrical safety requirements, raw material quality, and device performance. Ensuring all certificates and documents related to compliance are available is essential for smooth clearance.

Delivery and packaging – Proper packaging:

Proper packaging: Tea makers must be packaged in accordance with international and customs standards to prevent possible damage during transport. Packaging should protect the device against shocks and temperature fluctuations.

Supplying accessories: Providing and checking accessories accompanying the device is also part of the clearance process. These include spare parts, cables, and manuals, which must be delivered completely and correctly with the device.

Special conditions for import and export – Import:

Import: Tea makers are mainly imported to Iran from China, South Korea, and Taiwan. With rising domestic demand, import volumes have grown significantly in recent years.

Export: Iranian tea makers are exported to neighboring countries and some regional markets. Target export markets are expanding due to the need for high-quality products at reasonable prices.

Volume and global circulation

Import and export volume: Imports of tea makers into Iran are steadily increasing, while exports of these devices to other countries are also growing. Global circulation: The global tea maker market is broad and dynamic, with China, South Korea, and Japan recognized as the largest producers and exporters of these devices.

1) Key Points and HS Codes for Tea Makers

Tariff codes and classification

| Item | Short Description | HS Code |

|---|---|---|

| Electric tea maker | Electric kettle + brewing teapot | 8516.60.00.00 |

| Multifunction/professional/portable tea maker | Coffee/infusion/steamer/advanced control | 8516.79.00.00 |

Final classification depends on technical specs, power, additional features, standards, and application.

Need precise HS determination and document preparation? Our experts manage the case end-to-end.

Submit a Proforma Request

Frequently Asked Questions

What is the HS Code for tea makers?

Generally classified under 8516.60.00.00, and for multifunction/professional models under 8516.79.00.00; final determination depends on technical specs.

Which documents are required to clear tea makers?

Invoice/proforma, certificate of origin, certificate of compliance/standard, transport documents, declaration, duty receipts, and other paperwork as described above.

Are special tests and standards required?

Yes. Electrical safety and compliance with national/international standards are mandatory and will be checked by customs.

Special Customs Services by Saba Brokerage

Leveraging experience and expertise in customs clearance, Saba Brokerage provides comprehensive, specialized services for tea makers and other goods. These services include:

Specialized consulting: Providing accurate, expert advice on selecting the correct customs tariff code, preparing documentation, and tracking customs regulations and requirements. Our experts analyze your specific needs and, with awareness of the latest regulatory changes, offer the best solutions.

Document management: Collecting, reviewing, and completing all documents required for clearance, including invoices, proformas, certificates of origin, and compliance. This ensures all paperwork is prepared and submitted correctly for a smooth clearance process.

Coordination with customs authorities: Communicating and coordinating with customs bodies to facilitate and speed up clearance, reducing potential problems and delays. This step includes tracking customs cases and resolving any obstacles or delays in the process.

Packaging and transport services: Ensuring proper packaging in line with customs standards and coordinating safe transport. This includes overseeing packaging and ensuring appropriate transport conditions to prevent possible damage en route.

Post-clearance support: Providing post-clearance support services, including resolving potential issues and responding to client questions and needs. These services remain by your side continuously to address any special issues or needs that may arise after clearance.

With our team, you can complete the customs clearance process confidently and optimally and benefit from professional, efficient services.

.png)